Our theme song for the month should be Rick Ross’s “Everyday I’m Hustlin'” because that’s exactly what we did this month. I mentioned in September’s Debt Payoff Report that it was officially Q4 and this was the time when digital media influencers made the bulk of their income. For the most part, I wait for brands to come to me but this month I’ve been sending out all sorts of feelers which resulted in securing some great campaigns. I also want to thank everyone who has sent over their own debt payoff reports to me in the form of emails or messages on social media. You guys are rocking your Broke on Purpose Journeys!

[ad name=”HTML”]Admittedly, I’ve been working like crazy to bring in as much money as I possibly can. I even opted not to attend #GHOE (North Carolina A&T State University Homecoming) so that all my extra money could be put towards the debt. This was hard for me as I really wanted to go this year and to see all the “turn up” on social media didn’t make things easier, but I am determined to not take this balance transfer of Student Loan interest with us into 2017. Before I made myself sick like last month, I made sure to take a few “me” days where I did nothing but just relax by watching TV or reading books. It’s fulfilling to see our hard work paid off because this month we were able to throw almost $5000 at our debt.

Two Steps Forward take Two Steps Back…

Of course, this month did not come with setbacks. Marcus cleared up his Medical debt by using the money he would have added to our debt payoff pile. Once we cleared that hurdle we thought we were home free until we received a letter in the mail from our bank letting us know that due to property tax increases we were going to have to shell out $633 by November 17th. On top of that, we would also have to pay an additional 100/month with our mortgage payment to make sure our escrow is fully funded. For some property taxes are paid separately, but in our area, we pay taxes, mortgage, and insurance all in one monthly payment.

While I love being a homeowner, I don’t love are all the unexpected expenses that pop up. Owning a home is expensive, and it’s not something I recommend for anyone who is on a limited budget, but that’s a conversation for another day. Because we own a home, Marcus and I have a pretty healthy emergency fund. I know Dave Ramsey is all about the $1000 emergency fund, but I’m all “that’s a No for me dawg.” Only having $1000 in an emergency fund would give me constant anxiety, so we keep ours at $4500. To pay this increase in property taxes we’ve decided to take the money from the Emergency Fund and then build it back up. We could have taken the money that we were using to throw at the debt, but we really want to get this particular debt paid off as quickly as possible since it’s a balance transfer onto a credit card.

We also had to deal with repair to my car. It’s the second time I’ve gotten a nail in my tire, and I’m not sure how it’s happening. We pulled $168 from the car repair fund to satisfy that. This is another reason why we have more than one savings account. If would have had to pay the increased property taxes, plus the car repair this month with only $1000 in an emergency fund it would have been basically wiped out!

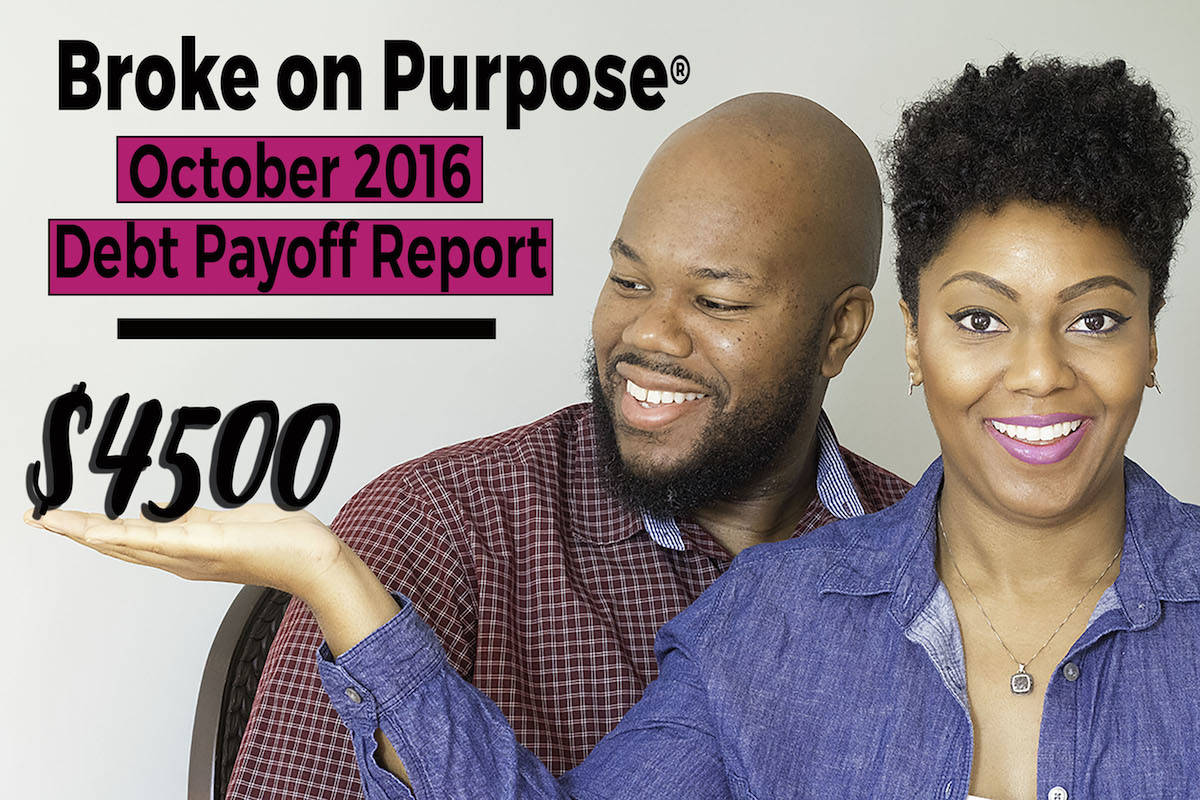

October 2016 Debt Payoff Breakdown

Balance Transfer Starting Balance: $17,674.00

October Starting Balance: $5712.00

Amount Paid Towards Debt: $4500

New Balance: $1212.00

Next Student Loan: $19,175.59

Amount paid since living Broke on Purpose (19 months): $62,071

Again, we went HARD this month. Of the $4500 we paid to the debt, $2,973 of that came from our side hustles and the money we had left over in our budget at the end of the month. During our budget meeting today Marcus and I agreed to go into November with the same intensity that we had this month.

Since our normal payment towards the balance transfer of $1572 will completely wipe out the remaining balance, we’ll direct the left over towards our next student loan that has a balance of $19,175.59. Jumping immediately to the next debt is mentally exhausting. I’d be lying if I didn’t joke with Marcus about taking a month off because even to us it seems never ending. We both know that this is a faith walk. Faith is the substance of things hoped for and evidence of things not seen. We don’t know what the end looks like, but we know it’s there, and we know that the fight is going to be well worth it.

Visit the Broke on Purpose Facebook Page

Like Broke on Purpose on Instagram

Grab the Broke on Purpose Ebook

I love the way you hustle! My side hustles keep us afloat!

We are brand new to the home ownership game, so after reading this, I am going to make sure to put a little away for unexpected setbacks! I have also given up a lot of my extra treats lately to make sure we can get everything paid.

I like the theme song. Great job.

You guys are so inspirational! Both of you deserve a pat on the back for keeping up your momentum for so long. Paying off debt can be so mentally exhausting, but you’ll be so thrilled when you make that last payment.

Oh wow, you guys are such an inspiration! I know I need to do better about sticking to my budget so I can pay things off faster. I’ll definitely be taking notes and putting some of these tips to good use. Thanks so much for sharing your journey!

This is something hubby and I definitely need to look into doing. Our oldest is going to college this year, and his top choice is a private college. We know it will give him the best possible education, so we are going to do everything in our power to get there. I need to get started on an emergency fund for us and for him!

I am in awe or your dedication and faith, but especially in awe of your HUSTLE! Get it Gurl! I’ve been working at chipping off our debts, but not with this much of a “get’em” attitude. I think that needs to change! I’d rather be broke ON purpose FOR a purpose, than just broke… and thats where we’ve been for a few months. IT SUCKS! You’ve given me hope!

I need some of you in my life! I am always struggling with money. I have the hardest time saving and putting money towards the more important things… I mean my bills are paid but i am a spender =( Ugh, sucks!! Keep up the amazing work!!!