I feel like every time I sit down to write one of these I’m always trying to figure out where the heck the month went. As an update, I’ve finished writing my dissertation, and now I am working on preparing my public talk or the defense as it’s usually called. This has kept me pretty much MIA with a little pop in here in there on social media. Once I’m done at the end of March I promise I’m going to ramp things up a whole lot, but until yall keep praying for ya girl!

[ad name=”HTML”]For the month of February, we did exceptionally well sticking to our dining out budget, so well that we had enough money take part in Lobster Fest at Red Lobster. We probably won’t ever be visiting that Red Lobster again because every single time we go there is an issue with the service and I feel that if I’m going to spend my hard earned budgeted money, then I want to have great customer service from start to finish and not only after I complain.

The Break Down

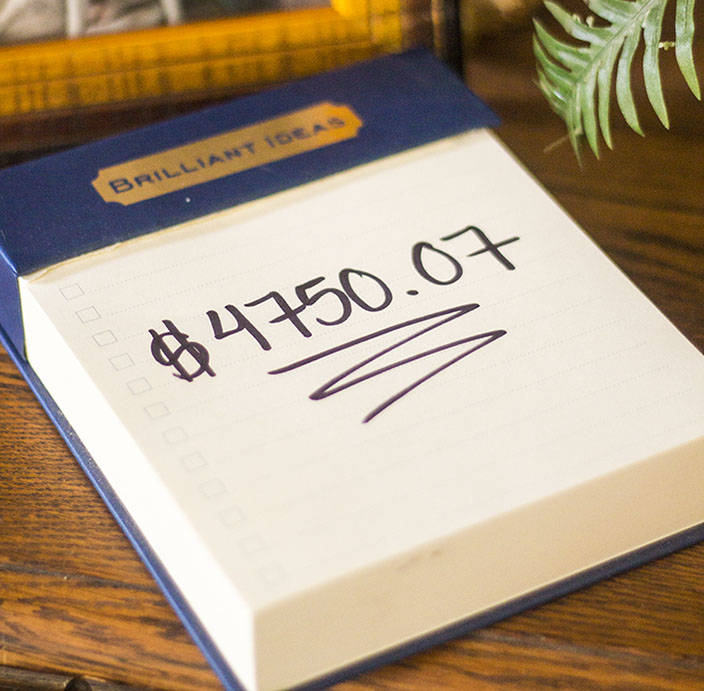

GREAT LAKES STUDENT LOAN STARTING BALANCE $18,373.25

New Balance: $11,083

Amount towards debt: $2230

Amount paid since living Broke on Purpose (23 months): $71,584

So, last month I wanted us to get this particular loan under $10,000 and as you can see we definitely didn’t come close to reaching that goal. Since I didn’t pick up any side gigs in January, there wasn’t really any extra money coming in for the month. We were able to put an additional $400 towards the debt using money that we had left over in our budget. Having that much money left over is an anomaly for us, and it probably stems from me not driving back and forth to work every day as well as us cooking at home instead of using money in our dining out budget. This is why you’ve seen so many of my “plated” food photos on my Instagram stories.

I’m excited to see the balance on that loan drop in March, as we’re planning to use a large chunk of our income tax refund to put towards the debt. I say a large chunk because Marcus and I allocated some of the refund money for our own personal use, and to pay for some other projects. While most would say just throw it all at the debt, for us it’s about balance. I also picked up a few side gigs towards the end February which will pay out in March.

As always thank you all for your support and for hanging out with us on the various Broke on Purpose platforms. Until next time, keep budgeting!

Y’all are doing a great job!!

Thank you so much Kendra!

Keep it the good work. Getting out of debt takes real work not easy fixes. I’m learning this the hard way. Thanks for sharing your story. It truly has inspired me.