Manage Your Money.

Live a Rich Life!

DO YOU WANT TO UPGRADE YOUR FINANCIAL FOCUS?

Find out what’s getting in your way and keeping you from staying on track.

DO YOU WANT TO UPGRADE YOUR FINANCIAL FOCUS?

You may know how to do a lot of things with your money but when it comes to managing it, that’s where you struggle the most.

Finances shouldn’t feel overwhelming and chaotic. When they do feel this way, you lose control and miss out on maximizing wealth building opportunities. Let me show you how to change that by creating a customized Money Management System™

I care about your financial future just as much as you do. Using my Money Management System framework I help my clients streamline their finances, optimize the flow of their money, reach goals faster and experience financial flexibility.

Everyone has a money story to tell, and suffering in silence won’t fix your financial issues. You’ve tried to fix your financial situation on your own before, but could never get things to work out. You’re frustrated and tired of having nothing to show for all your hard work. You’re tired of debt ruling your life.

HAVE YOU EVER SAID TO YOURSELF:

-

I make too much money to be struggling this much with my finances.

-

I wish I had a financial plan that was customized for me and my situation instead of for everyone elses.

-

I want to be better with my money but it all feels so overwhelming when I try to do it myself!

-

I'm tired of going to work only to pay bills and pay off debt. I want to be able to enjoy my money now.

Everyone has a money story to tell, and suffering in silence won’t fix your financial issues. You’ve tried to fix your financial situation on your own before, but could never get things to work out. You’re frustrated and tired of having nothing to show for all your hard work. You’re tired of debt ruling your life.

HAVE YOU EVER SAID TO YOURSELF:

-

I make too much money to be struggling this much with my finances.

-

I wish I had a financial plan that was customized for me and my situation instead of for everyone elses.

-

I want to be better with my money but it all feels so overwhelming when I try to do it myself!

-

I'm tired of going to work only to pay bills and pay off debt. I want to be able to enjoy my money now.

Everyone has a money story to tell, and suffering in silence won’t fix your financial issues. You’ve tried to fix your financial situation on your own before, but could never get things to work out. You’re frustrated and tired of having nothing to show for all your hard work. You’re tired of debt ruling your life.

HAVE YOU EVER SAID TO YOURSELF:

-

I make too much money to be struggling this much with my finances.

-

I wish I had a financial plan that was customized for me and my situation instead of for everyone elses.

-

I want to be better with my money but it all feels so overwhelming when I try to do it myself!

-

I'm tired of going to work only to pay bills and pay off debt. I want to be able to enjoy my money now.

START TRANSFORMING YOUR FINANCES BY:

1.

OUTLINING

YOUR FINANCIAL GOALS

2.

USING MY PROVEN FRAMEWORK

3.

LIVING YOUR VERSION OF A RICH LIFE

1.

OUTLINING

YOUR FINANCIAL GOALS

2.

USING MY PROVEN FRAMEWORK

3.

LIVING YOUR VERSION OF A RICH LIFE

Work with me 1:1 to transform your finances by creating a customized and strategic Money Management System to help you streamline your finances and master your money!

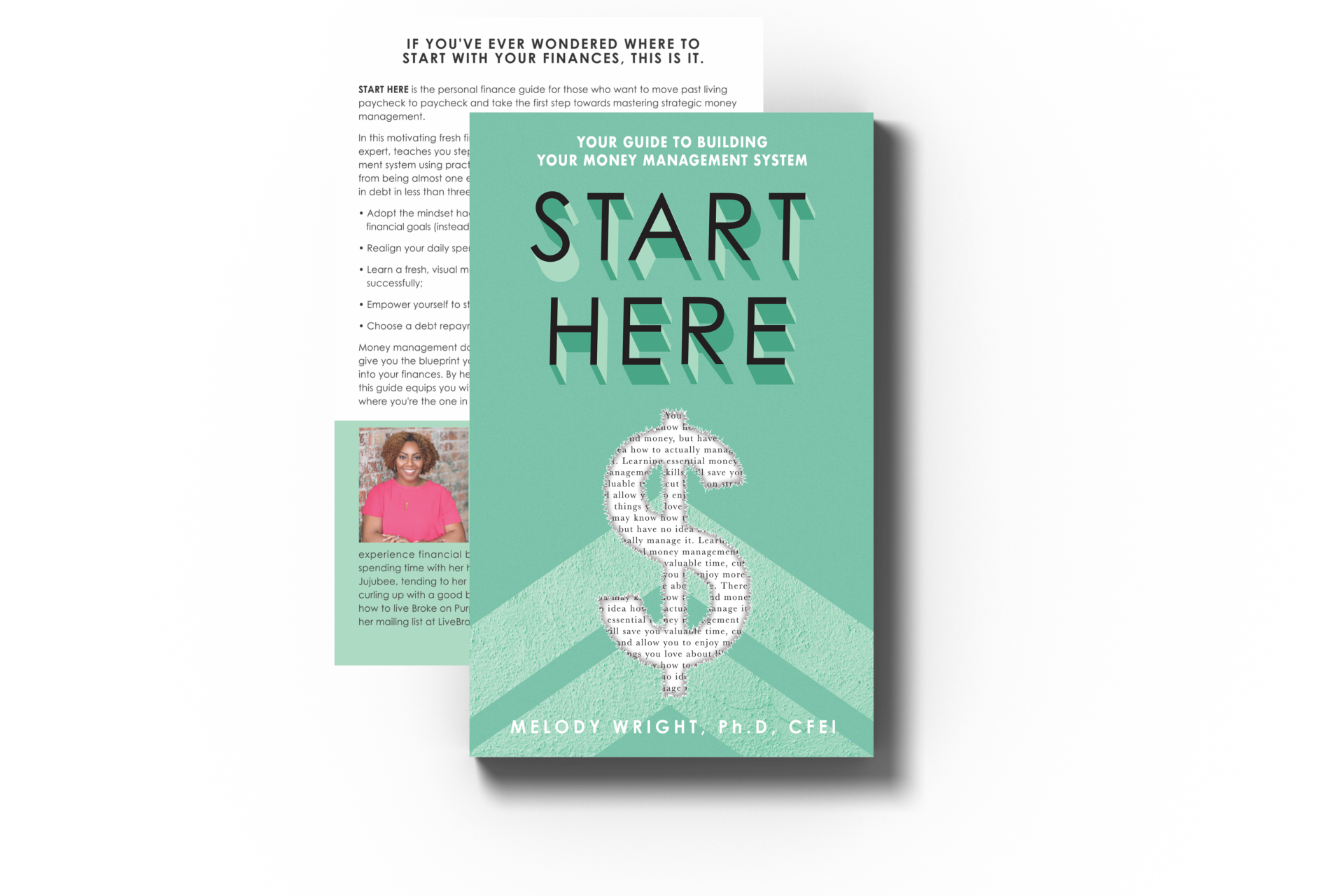

Order your copy of my newest book. START HERE: Your Guide to Building Your Money Management System.

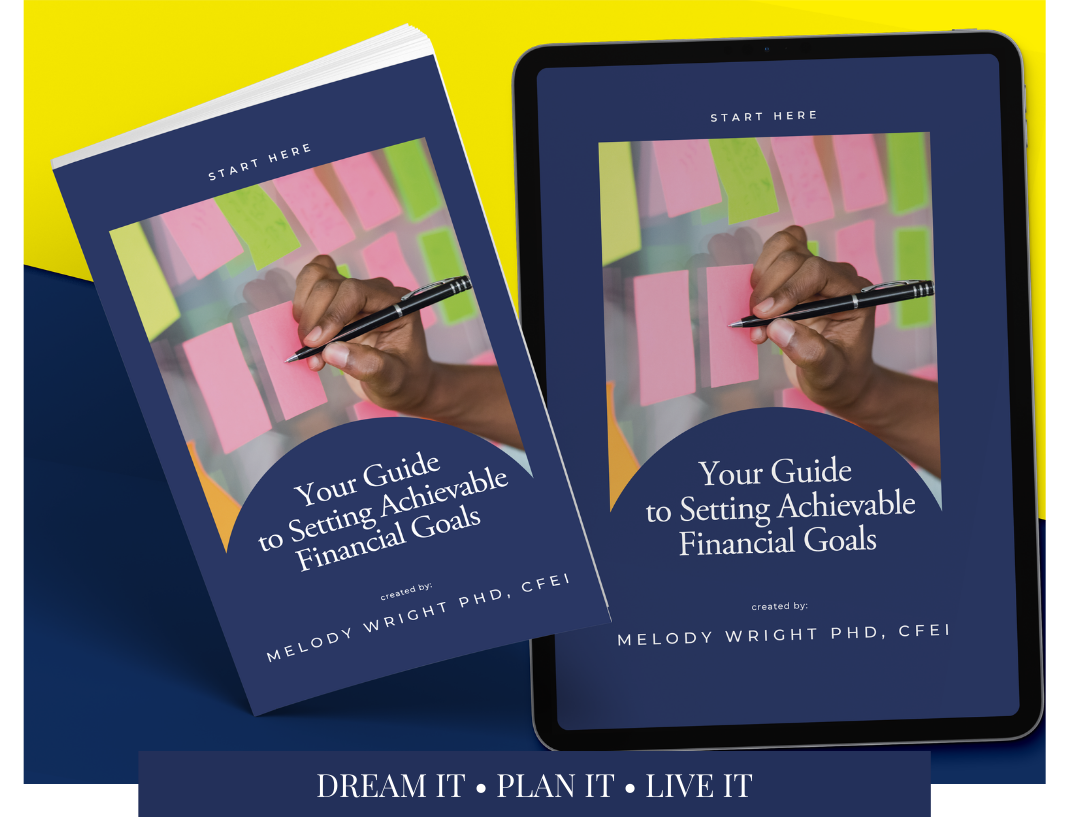

Create a Financial Roadmap to help you stay on track, stay consistent, and reach your financial goals.

Work with me 1:1 to transform your finances and create a customized strategic Money Management System to help you streamline your financials and master your money!

Order your copy of my newest book, START HERE: Your Guide to Building Your Money Management System.

Create a Financial Roadmap to help you stay on track, stay consistent, and reach your financial goals.

Meet Your Future Financial Coach

I'm Melody!

I'm Melody!

I’m a Ph.D trained Parasitologist that traded in her safety googles and pipettes to become a Financial Empowerment Coach and Certified Financial Education Instructor. I know what it feels like to be facing a mountain of debt so large that all you want to do is run and hide. I also know how it feels to stand up to your financial situation and tell that mountain to move. I developed a proven framework that helped my family pay off over $100K in less than three years. Now we’re living our version of a rich life. I want to help you do the same by teaching you how to reframe your money mindset and and learn how to strategically manage your money so that it provides you with the ability to live your version of a rich life!

FEATURED ON:

ENHANCE YOUR FINANCIAL KNOWLEDGE

HOW CAN I HELP YOU

UPGRADE YOUR FINANCES?

Meet Your Future Financial Coach

I'm Dr. Melody Wright!

I’m a Ph.D.-trained Parasitologist who traded her safety goggles and pipettes to become an Accredited Financial Empowerment Coach and Certified Financial Education Instructor. I know what it feels like to face a mountain of debt so large that all you want to do is run and hide. I also know how it feels to stand up to your financial situation and tell that mountain to move. I developed a proven framework that helped my family pay off over $100K in less than three years. Now we’re living our version of a prosperous life. I want to help you do the same by teaching you how to reframe your money mindset and learn how to strategically manage your money so that it provides you with the ability to live your version of a rich life!

FEATURED ON:

FEATURED ON:

ENHANCE YOUR FINANCIAL KNOWLEDGE

HOW CAN I HELP YOU

UPGRADE YOUR FINANCES?

ENHANCE YOUR FINANCIAL KNOWLEDGE

HOW CAN I HELP YOU

UPGRADE YOUR FINANCES?