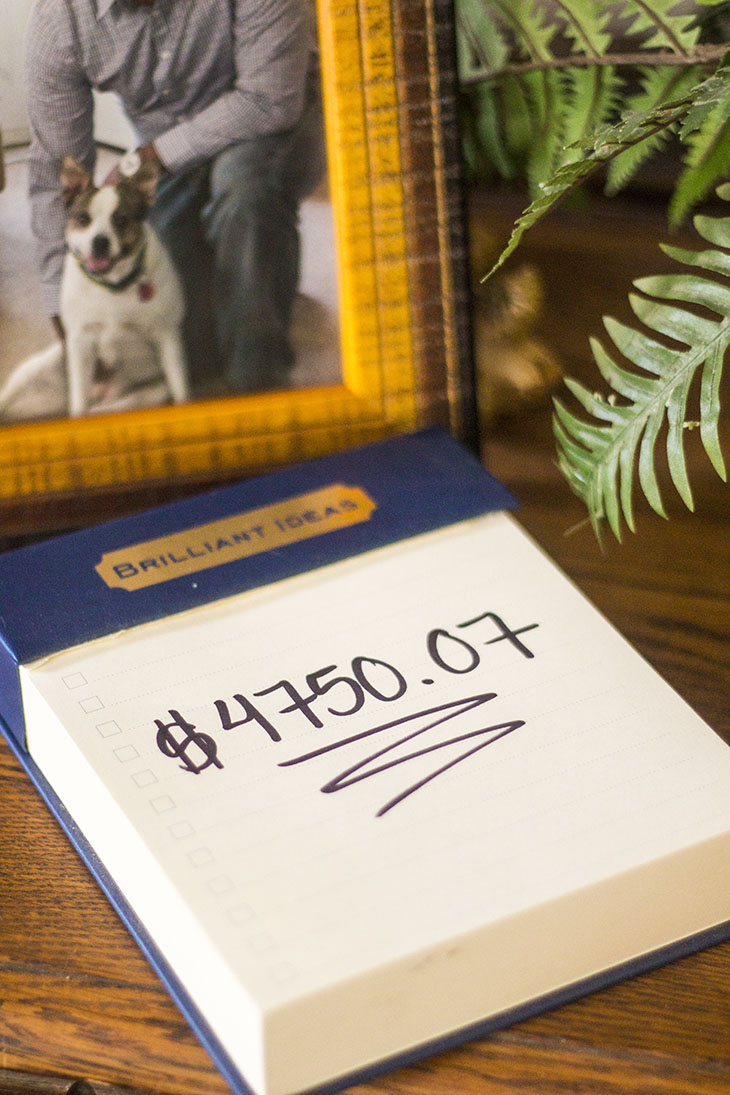

April is officially over (basically) and I have $69 left in my bank account, but this month has been amazing! We have paid off $4750.07 in debt well exceeding what we’d originally planned to do. Now I fully understand exactly what Dave Ramsey means when he tells callers not to get overwhelmed with the time it may take to pay off a debt. On paper, it may tell you one thing, but when you become Gazelle Intense and get mad at your debt things will start to happen that will change the end date on that paper entirely. At the beginning of April we set a plan for wanted to achieve as shown below:

Let’s start with numero uno shall we? If you’ve been following this series then you know that I sacrificed my favorite, and the only pair of Valentino’s to our debt (you can read about that here). By selling them, I was able to pay off the Paypal Balance in full on April 12th. It was a sacrifice I was willing to make in order for us to get to close to our finish line faster. The next debt on our list for this month was my car which is a 2013 Kia Optima, on paper we had a payoff date of July 2015, but after pouring over the budget obsessively, like I do most days, I saw a way that we could actually pay the entire thing off in one fell swoop. Since my Husband travels a lot and has racked up loads of reward miles we were able to book a week-long vacation in Aruba and our only out of pocket expense was $100. We’d been putting money aside so that we would have spending money to take with us. The amount that we’d saved for spending money coincidentally equaled just we needed to completely pay the car off this month. However, in order for this to work, we would have to move our vacation back two months, which would allow us to resave the money we were planning on using for the trip. I’ll admit this was a hard sell when it came to presenting this idea to my husband. Neither one of us likes to part with money, but this is where communication is important as well as a pouty face and a good “please baby please”. When I made my presentation I listed both the pro’s and con’s of us pushing the vacation back and paying the car off two months early and at the end of a very exhausting argument, he agreed. As of April 28th, 2015 the Wright Family has officially joined…

I’ll admit the feeling is still surreal. We were able to pay off our car in 22 months saving us hundreds of dollars in interest. We only have one more thing to pay off before we tackle our Mount Everest of student loans. The exciting part of all this is that our next debt has a planned pay off date of around the end of June or early July now that the car payment is out of the way and we’re able to roll that payment into our next one thus following through with the snowball. We were also successfully able to put $500 into savings this month allowing us to meet all of our goals! Next month I plan to list what our minimum payment is on each debt as well as what we’re snowballing in to give you all a better idea of how the snowball is working.

So tell me how was your month of being Broke on Purpose? Did you knock out some debt? Make a Budget? Or do you plan to get it in gear for the Month of May? Share your comments below and lets chat!

Follow my Broke on Purpose Journey by Visiting More Post Below.

Broke on Purpose the Beginning

Broke On Purpose: You’ll Make It Work

Broke on Purpose April 2015 Goals

Broke on Purpose: April Wrap-up. We’re officially Team No Car Payment!