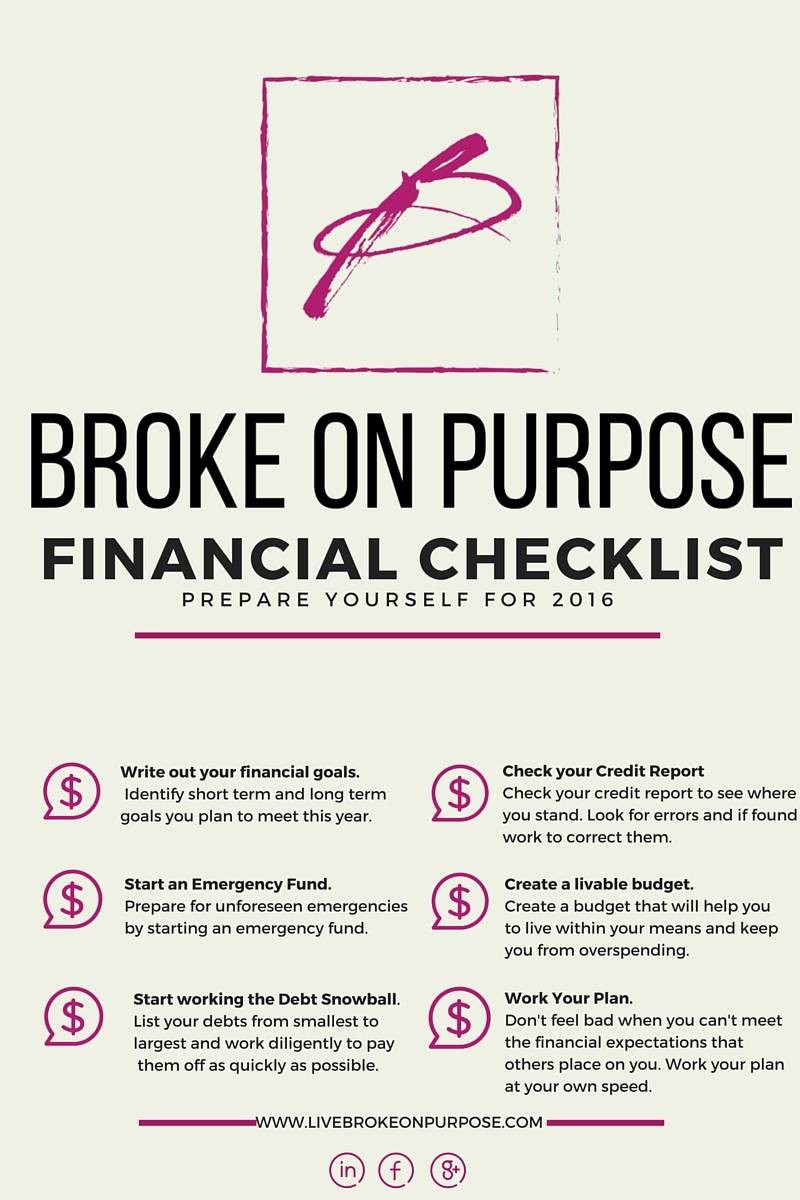

The new year is a great time to sit down and start planning out your financial success for the upcoming year. Too often do we sit down and make new year’s resolutions only to find that we’ve abandoned them before March is over. This year Broke on Purpose is here to help you keep your financial goals whether they be big or small. This easy to follow 2016 Financial Checklist is the perfect thing to help you initiate your financial journey. Print it out and put it on your refrigerator, stick it in your day planner, or wherever you sit down to do the monthly bills.

Write out your financial goals.

I’m a firm believer that words gives things power. By writing down your financial goals, you are doing more than just speaking them into the universe you’re creating a document that will help hold you accountable. Write out short-term (1-3 months) and long-term (6-12 months) attainable financial goals. Maybe you want to save up to purchase a new car or pay off 50% of your debt. No matter what it is make sure to write it down somewhere where you can always see it to help remind yourself of your plan.

Create a livable budget.

After writing out your financial goals, the next thing you should do is sit down and write out a liveable budget. A budget is a great resource that allows you to dictate where you money is going. A budget helps you live within your means and keeps you from overspending. If you find that you’ve got more going out than you have income coming in than it may be time to cut back on some things.

Start an Emergency Fund.

Unfortunate things are going to happen. That is inevitable. While you can’t control what happens you can control how prepared you are for the situation. Start an emergency fund to cover these unforeseen emergencies. You can start an emergency fund with as little as $500. Just be sure to put it somewhere that won’t tempt you to touch it.

Check your Credit Report.

Each year you’re entitled to a free credit report. Again, you should not have to pay for a credit report. Look through your credit report to identify any discrepancies. If there is something that is incorrect take action to correct it immediately. Your credit report will also give you an idea as to whom and how much you owe which is a great resource when creating your debt snowball. You can get a free credit report at freecreditreport.com

Start working your Debt Snowball.

Using your credit report you can list all your debts from smallest to largest and create a debt snowball. Work hard to pay off the debts in the order that they are arranged. The more you pay, the faster the debt snowball goes. If you’re unsure about how to set up a debt snowball check out this post here.

Work Your Plan.

No matter where you are financially don’t get discouraged when you see others making financial strides faster than you. Remember, everyone’s situation is different and you shouldn’t allow the financial expectations that others put on you to make you feel guilty. Stay diligent and work your plan.

Download a copy of the 2016 Financial Checklist here! Are you looking for a more in-depth guide to accompany the 2016 Financial Checklist? Be sure to check out the Broke on Purpose Ebook!