Windfall Money is a term used to describe money you unexpectedly receive.

Windfall money can come in the form of winning the lottery, receiving an unexpected reimbursement for overpayment, or even an unexpected inheritance. To me, it’s actually some of the best money you’ll ever get because it somehow always arrives at a time you need it most.

[ad name=”HTML”]The most important thing about windfall money is knowing what to do with it once it falls in your lap. 70% of people who receive large windfalls like lottery winnings blow it all within a few years, and then they’re back to where they started financially or often worse off.

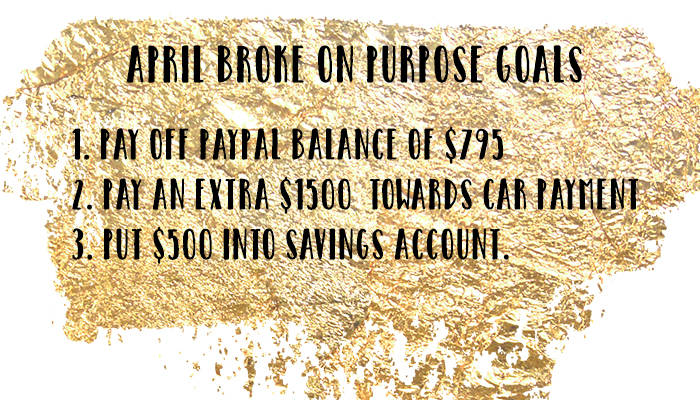

Marcus and I have received a few windfalls here in there in the form of overpayment reimbursements and to be honest with you before starting Broke on Purpose we maybe spent it in ways that weren’t too practical like going on shopping trips or dinners out. We just recently received a reimbursement check from the bank for over $1600. As soon as saw the amount I immediately started making plans for the money, but that’s not always the bet thing to do. Instead of being like me here are three ways to handle receiving windfall money.

1. Pause

Windfall money can trigger a lot of emotions, even from people who it technically didn’t go to. Before spending the money, you want first to make sure that the money is yours to keep. I’ve heard horror stories of people spending windfall money only to find out the money was sent to them in error. Depending on the amount of money you received it may be a great idea to take some time before making decisions on how to use the windfall. Put the money in a savings account and over the next few days allow the initial shock of your new found wealth to slowly make its way through your system.

2. Plan it out

During this moratorium, plan out ways the windfall can benefit you best. If it’s a seriously large amount it’s may be best to speak with a financial advisor. For small amounts think about how using the extra money could speed up your debt snowball or if you’ve been struggling with saving money turn it into an emergency fund. Putting a large amount on your debt can really speed up your process by a few months. If your debt is paid off, there are several ways you could invest the money so that it continues working for you throughout the years.

3.Don’t forget about Yourself

You always hear the saying “Pay Yourself first.”. This is something Marcus, and I always do whenever we receive windfall money in larger amounts. Even if it’s only $50 each, paying yourself is a motivational boost as often it can feel like all you’re doing is paying down debt. It’s also nice to see a little extra money in your checking account.

Going forward we plan to follow these steps when we receive large amounts (over $1000) in windfall money. Doing this will help us make better decisions in the long run and keep us on track towards reaching our financial goals.