[ad name=”HTML”]

I’m sure you’ll agree with me when I say 2016 has been quite a year! Many people are ready for it to be completely over I just can’t help but sit back and want to reminisce about our year. When we originally started Broke on Purpose, the goal was to get control of our declining finances and in doing so start a conversation about money. We weren’t looking for any big life-changing things to happen we simply just wanted people to become more financially aware. The best way we knew to do this was to share our experience. One my personal goals was to talk about Broke on Purpose® on a larger platform, but we never thought we’d be featured on the nationally syndicated talk show Rachael Ray!

These past twenty-one months of living Broke on Purpose has taught us many lessons. We’ve learned that we can live on less and still have an amazing life. We didn’t realize how much our debt was controlling us until we started to pay it off. First, we released ourselves from the bondage of credit card debt, next it was car payments, and now we’re slowly loosening the grasp that our student loans have on us. We learned to say no to traditions and work out better plans that fit within our budget. You do not have to spend money on to celebrate certain days just because societal traditions say so.

Has it been easy? Hell No! Has it been worth? Absolutely!

There is something magical about being able to wake up every morning and know that our sacrifice has been worth it. Yea, pretty much all we do is work, payoff, debt, and repeat, but the freedom we feel each and every time we make a payment and watch our balances become smaller and smaller is worth those late nights and early morning. It’s worth skipping vacations, eating leftovers, telling friends/families no, and cutting back on cable. In the grand scheme of things, these sacrifices are minor compared to how far we’ve come.

The BreakDown

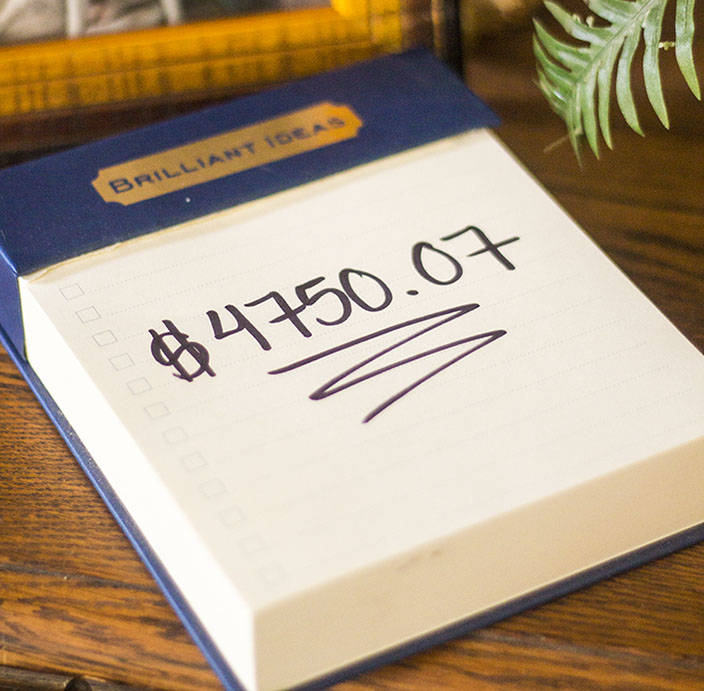

GREAT LAKES STUDENT LOAN A $18,373.25

New Balance: $15,476

Amount towards debt: $2897.00

Amount paid since living Broke on Purpose (21 months): $66,819

This year we paid off a total $37,313 of our debt. For the month of December, we were able to pay off $2897 bringing our Great Lakes Student Loan balance to $15,476. Initially our goal at the beginning of 2016 was to pay off $50,000, and for awhile I thought we were on track to do that until I started to experience a bit of burnout, and so I took a step back from some of my side jobs. I would be lying if I told you that I never thought about throwing up my hands and stopping this journey.

It. Gets. Hard.

Who wants to work their butt off day and night only to hand away their earnings? Proverbs 22:7 says “The Debtor is Slave to the Lender.” I never fully understood the enormity of this verse until I realized that I couldn’t live my life the way I wanted to because I owed so many people money. Imagine if you could keep all the money that you had going out in minimum payments. How different would your life be? The thought of this gives me chills. It’s important to remember that ANYONE can do this but your journey isn’t going to be the same as the next persons. Having kids or a single income doesn’t exclude you from the ability to change your financial situation as we’ve helped counsel people in these exact situations. It just takes a plan and the determination to want to change.

So, we’re stepping into 2017 with a little over $144,000 of debt left to pay off. While this number seems like a lot and can be discouraging I always remember to look back at where we started. In the beginning, $212,000 seemed like an impossible number to tackle, but we’ve come this far by faith and with teamwork. This year I’ll finally be finishing my Ph.D. which in theory will equate to a salary increase. By the end of 2017, our goal is to be under $100,000.

You can check out previous Monthly Payoff Reports to see how we’ve done month to month.

We want to give our sincerest thank you to everyone who has been following our journey. Thank you for all the words of encouragement. We honestly consider you all to be our accountability partners and because of you all we’re committed to seeing this thing out to the end no matter how hard it might get.

Ready to start your own Broke on Purpose Journey? Check out some of the products we have in our STORE including our Broke on Purpose Ebook and Worksheet Bundle along with the Money Envelopes found below to help you get started.

Amazing job!