Guess what? You owe it to yourself to get your finances together. Forget the whole “new year new me mantra.” This is a start today new life commitment mantra. If you’re tired, if you’re frustrated, if you feel like no one understands where you are financially then you’ve got to start today. Maybe you hadn’t realized it yet you’ve already started? You already told yourself enough was enough. You already told yourself you wanted a change. By reading this blog post, and taking notes of what’s in the Financial Checklist you’re already making a difference in your life. If finances aren’t you’re “thing”, then this is where you start with this simple checklist. Be sure to pin it so that you refer back to it later!

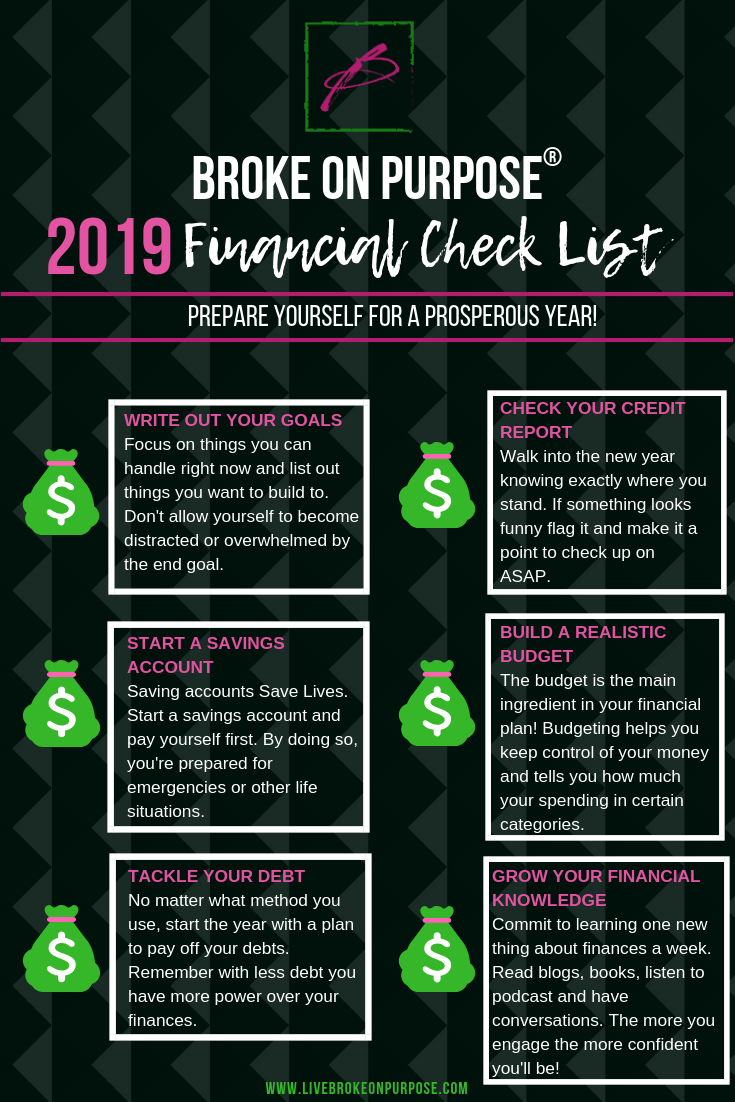

Write Out Your Financial Goals.

It’s easy to become overwhelmed when all you can think about is being Debt Free. Can I tell you a secret? Being Debt Free should not be the main goal you focus on and here’s why. It’s OVERWHELMING! How many times have you thought about being debt free, sat down took of look at your finances, and then just decided it was too much? By focusing on a big goal like being debt free, you’re psychologically defeating yourself before you’ve even started!

Break your goals out into mentally manageable pieces that you can handle and then tackle them one by one. Remember, it’s about what you can handle now. The rest will fall into place as you keep going.

Create a Livable Budget.

After writing out your financial goals, the next thing you should do is sit down and write out a livable budget. It’s easy to get caught up in saving money and wanting to pay down debt to the point where you make unrealistic budgets. Make a budget that works for you and you’re family. Don’t force yourselves to try and make it on $100/month for groceries to feed a family of four if you don’t have to. You might save money, but you’ll end up with more resentment and chaos than anything.

Don’t think of budgets as these things that are put in place to control your life, but think of them as more of a GPS. It helps to keep you in line with your spending so that you can get to your final destination of being debt free. We hold budget meetings every month to plan out our budget for the upcoming month and to discuss where we could improve and how we messed up. Not sure how to get started with a budget? Grab a copy of the “Get Out Of Your Feelings and Into Your Finances” worksheet bundle explicitly created to help you jump begin your financial journey.

Start a Savings Account

Saving Accounts Save Lives! They do! I can share many stories of how my savings account has had my back. It even allowed me to tell my employer to take back the paycheck they’d messed up (read all about that here). We have over ten savings accounts. You’ll always hear people telling you to put money into an emergency fund to cover emergencies. They’ll probably even tell you that it should have $1000 in it. This is where I’m different; I don’t care how much money to decide to have in your emergency fund or general savings account as long as you have one. You need something to fall back on should an emergency arise.

Plot twist! You can also be actively saving up money and paying down debt. It’s 100% doable. Come up with a savings goal and work towards achieving it. When you reach that amount increase it if you’d like. If you can sleep peacefully with the current amount, then divert the funds to another important area. Just make sure the account is in place. We love Capital one 360 because it offers FREE, yes I said FREE saving accounts along with a 1.0 APY! Plus there are no minimums! This setup is pretty dope considering your bank is going make you keep a minimum and is only giving you a .01% APY at most. If you sign up today, you get a bonus for starting an account.

Check Your Credit Report.

Each year you’re entitled to a free credit report. Again, you should not have to pay for a credit report! Let me repeat that for the people in the back. STOP PAYING FOR A CREDIT REPORT!. Look through your credit report to identify any discrepancies and make a note of all the balances. You can use this information as your starting point for creating your debt payoff plan or planning overall financial goals. If there is something that is incorrect take action to correct it immediately. Your credit report will also give you an idea as to whom and how much you owe which is a great resource when creating your debt snowball. You can get a free credit report at freecreditreport.com.

Also, in 2019 can we stop paying people to “fix” or credit. Here’s an area where you can most definitely save your coins. Most of your problems can be solved by simply typing and sending in a written correspondence. All it’ll cost you is your time, an envelope, and a stamp. If the site offers digital correspondences, it’ll only cost you your time.

Tackle Your Debt

Debt payoff plans are not one size fits all. It may be tempting to start with the debt snowball and if you need that mental push then, by all means, do it, just don’t forget about the other methods out there like the debt avalanche or the twister method. Switching from the debt snowball to the debt avalanche saved us thousands of dollars. Before committing to a plan do the math, and see which methods will better fit your situation. If you have very high-interest rate debt’s the snowball may not be the best method for you, I mean this is why it’s called PERSONAL finance right?

Grow Your Financial Knowledge

One of the main reasons I hear for why people mess up with their finances is “we weren’t taught this growing up.” While we can’t change the past, we can focus on the future. Grow your financial knowledge by engaging in conversations about finances. Read blogs, like this one, pick up a recommended book, or listen to a podcast. There is a wealth of fantastic information out there that will help you stay on track; you only have to seek it out.