In the last post (Why You Should Rethink Where You Save Your Money), I shared with you all that we have over ten savings accounts. I guess you can call us Saving Account hoarders, but honestly having a designated place to put our money has become addicting. You already spend a good amount of time creating a budget or in your families budget meeting so, why not at the time same time create a plan for how you plan to gain and store that money?

We don’t just up and create saving accounts because we feel like it, but we build them based on things that are happening in our lives or based on things that we know we’re going to need money for. Honestly, online saving accounts are favorite of mine in terms of financial tools next to my beloved money envelopes, except these are basically digital money envelopes. Having these account makes budgeting a breeze as we can easily look to see how much we have without spending too much time. Plus each account earns 1.0% interest so we’re making money while saving money.

As mentioned online saving accounts are great as they allow you to save for long-term and short-term goals as well as prepare for emergencies. One of the worst times to start saving up for an emergency is when that emergency is actively taking place. Ever need new tires and not have new tire money? Trust me; I just went through that with my laptop. I’d had my MacBook Pro since the beginning of 2011. It helped me build two brands and got me through graduate school. While I had thoughts of replacing it, I didn’t feel a need because it did everything I needed it to do and did it well. That is until I spilled ranch dressing on it. Don’t ask me how I did it; I’m already embarrassed enough as it is. Long story short, our best efforts couldn’t save the computer, and I was forced to get a new one. Here’s the worst part. I actually started saving up for a new computer at the beginning of the year and then decided I didn’t need one and used that money to buy a new camera lens instead. So here I was facing this emergency of needing a new MacBook Pro, and I didn’t have any money earmarked or saved to get it. Don’t let this be you. Don’t wait until you’re in the face of an emergency to wish you would have prepared for it.

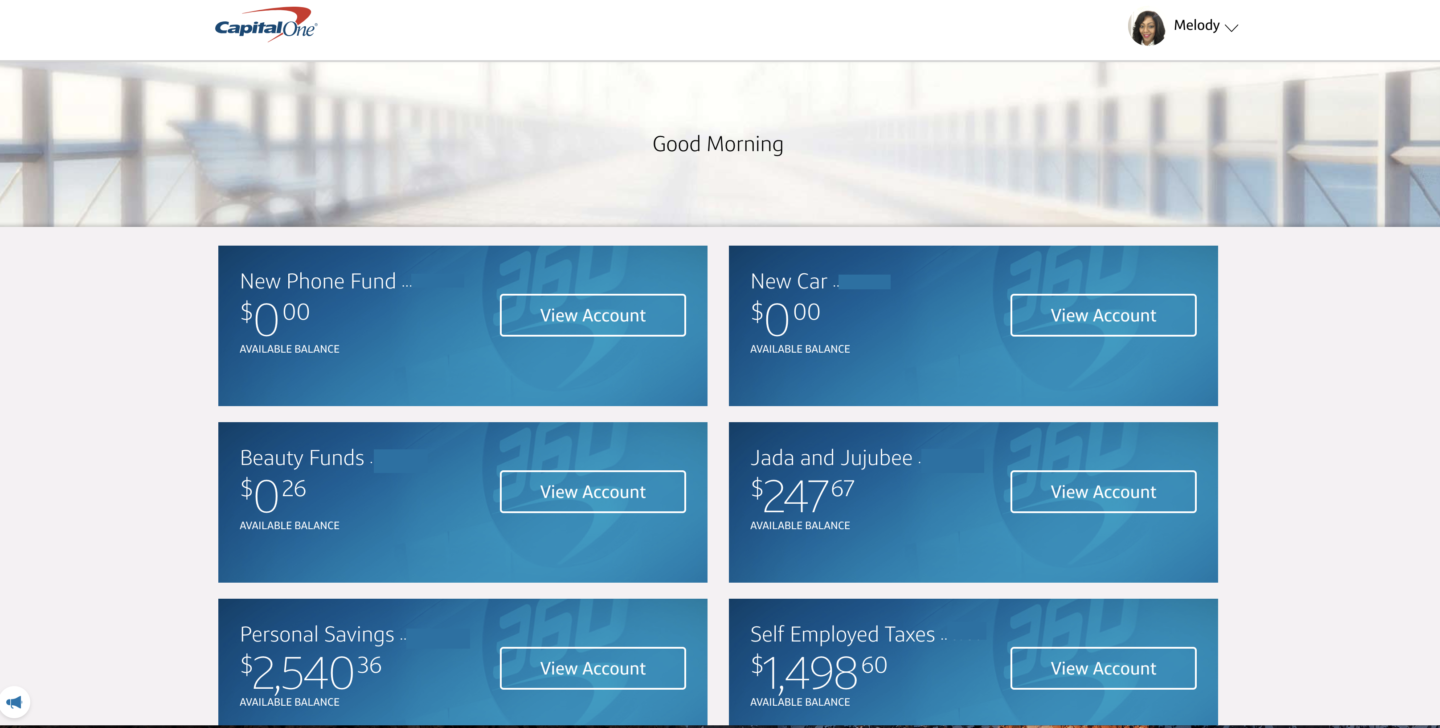

Several people have inquired as to what we’re saving for I thought it would be helpful and fun to share our short term and long term savings goals. Remember, with Capital One you can give each of your Saving Accounts a nickname like below, and it’ll show up on the front page when you log in.

[ad name=”HTML”]Long Term:

New Car: Our oldest car is almost 10 years old and while she’s still a road warrior and we plan to ride with her until she can’t go anymore that doesn’t mean we shouldn’t start saving up for the next purchase. We’ve already agreed that our next car won’t be more than $25,000 and we plan to purchase it used. As we hope to not need a new car for another three to four years, we’re only doing $100/month to this fund to start, and we’ll increase that amount as time goes on.

Down Payment: We’ve been in our current home for over five years, and while we like it here it’s just not our forever home. I am in desperate need of a bigger kitchen so that I can entertain to my heart’s content. I’m over the pink and black tile in our bathroom, I want a soaker tub with a separate shower, and is it too much to ask for a bigger closet? With that being said we’re looking to upgrade, but we are making sure to go into this way more prepared then we were when we purchased this home. We’ve decided that we want to purchase a home between $250K-$350K which means we need at least a $70,000 down payment. This is feasible if we save $15,000 a year for five years or we could do it in two if we buckle down and do like we did when we were all about paying off our debt.

3-6 months of Living Expenses: For those of you that follow a certain set of steps you might be thinking to yourself that we’re doing this all out of order, but for us, it really comes down to preparation. Taking the advice from a real life “millionaire next door” that we know and love we’ve decided it’s important to make sure we have a sizeable amount of money tucked away so that we’re prepared for whatever life may bring us. In the midst of a situation, the last thing I want to think about is finances. If we’ve already taken the steps to prepare for a loss of income it makes that experience less dauting. This money is not part of our emergency fund which we also have.

Short Term:

New Phone: Marcus and I have had our same cell phones since 2015. There is nothing wrong with them now *knock on wood* and they’re still pretty current considering all the newer models that have come out since then. Yet, we know that soon the technology on our phone won’t be able to support all the new upgrades and so we’re saving up for the day our phones become dinosaurs. We’re also saving up to purchase our phones outright. To me leasing your phone or being on those “new phones every year” plans aren’t worth it. Plus, I hate seeing our bill so high due to payments on the phone. We’re saving $50 a month to this fund.

Vacation: Is it embarrassing to admit that we haven’t had a proper vacation in seven years? First, it was because we bought the house, then it was because we decided to pay off debt. We are due to be laying on someone’s sandy beach, and we plan to make that happen hopefully in the very near future. While we plan to pay for this vacation with our credit card so that we can reap the benefits of the bonus points (yes we do use a credit card) we want to make sure that we can turn around and pay it off within 24hrs, you know to give it time to post to the account.

Jada and Jujubee (Dog Fund): Jada and Jujubee are our two loyal furry companions. Each year without failure Jujubee seems to have some type of medical issue that needs vet attention, so we’ve gotten into the habit of putting money aside to cover these cost every month. We also use this money to pay for their monthly pet meds, vaccinations, or whatever else they may need beyond dog food.

Car Repairs: I will never forget the time Marcus waited until the last minute to have his yearly car inspection done and were hit with an $800 repair bill that we were not prepared to pay. After getting on him about his procrastination, I vowed we would never be put in that predicament again. Every month we put $150 into this saving account and cap it at $2000. We stop at $2000 because it’s more than enough to pay for new tires, oil changes, and any other repairs that might pop up throughout the year. Once each of us has done the yearly car maintenance needed we work to build it back up and then let it sit until it’s time for next year.

Home Repairs: This account is just like the car repair account. With our home being a bit older we’re bound to have to make repairs here or there. Sometimes we may even want to do a bit of upgrading. While most people would use their emergency fund for this type of thing we’ve decided that it doesn’t hurt to have money set aside earmarked for this type of thing. Plus, the Capital One Savings Account is free so why not?

Christmas/Birthdays/Holidays: All three of these things can sneak up on your if you’re not prepared. At the beginning of the year, we decided the monetary amount we want to spend and then divide that by 12. That’s how we come up with how much we put aside for the year. This is great because it also allows us to place boundaries on ourselves for how much we’re spending on gifts. It’s easy to overspend when you are purchasing for someone you love, however when you go in with a set dollar amount it allows you to be more creative and really put thought into a gift. This has worked for us for the past two years, and no one has been disappointed yet.

Seasonal Clothing Purchases: I do a capsule wardrobe, and share all about it here. If you’re somewhat a minimalist like I am, you’ll love the ease an functionality of a capsule. While it’s not as strict as wearing a “uniform” every day, it still allows you to downsize your wardrobe while still being fashionable. Each season you can add new pieces to your capsule to replace anything that is worn out because I like to buy better quality items with a longer wear life (not saying I won’t rock a dress from Target) I save up to be able to purchase a few key pieces every year. By doing research beforehand, you can note when sales are going to happen at your favorite stores so that you can be prepared to save for items you already earmarked to purchase.

Beauty Funds: Just like with my clothing I tend to only buy my beauty items when I know I can get an extra percentage off. Because of this, I take full advantage of Sephora’s VIB sale as well as their Holiday items. Having natural hair allows me to the ability to do my hair at home minus trips to the salon for a trim. For my beauty fund, I put aside $40/month which is more than enough for me to restock my favorites of purchase something new or take care of my hair care needs.

Self Employed Taxes: As a small business owner I’m required by law to pay quarterly taxes. I’ve seen several people get burned by glossing over the fact that the IRS doesn’t play when it comes to their money. To make sure I’m never in that situation I set up a savings account strictly for my Self Employed Taxes. Each month QuickBooks tells me how much should be in there based on my earnings and expenses and I make sure that the money is ready to go come time to make quarterly payments. Having this separate savings account allows me the ability to easily keep my profits separate from what I owe the IRS.

Not mentioned above is my personal savings account that I stash away a portion of my mad money into every month. The idea of having multiple savings accounts may seem excessive but as you can see in the breakdown there is a method to our madness. These savings accounts give us a visual picture as to how well we’re doing towards meeting each one of the goals we set It also places clear boundaries on what you’ve specific use you have for that money. For me, it also relieves anxiety because I know we’re prepared in case something were to happen. While some banks do offer for you to have savings goals within saving accounts I feel that still can lead to money being intermingled, mixed, or accidentally used for something it wasn’t intended.

If you don’t have a Capital One Online Savings Account you can today sign up through this link and get $25 when you open your first account! Remember there are NO FEES AND NO MINIMUM.

This was SOOOOO helpful!!!