As I lay in bed scrolling through IG stories, I watched as someone I followed announce that they were on Day 26 of the Government shutdown with no hope in sight of being called back to work. I did the math and realized many people were coming up on a second pay period where they would not receive their paychecks. I begin to wonder how long the government expected this to go on and how mentally and emotionally draining it must be to have your entire life held in limbo by people who valued a wall more they valued your livelihood.

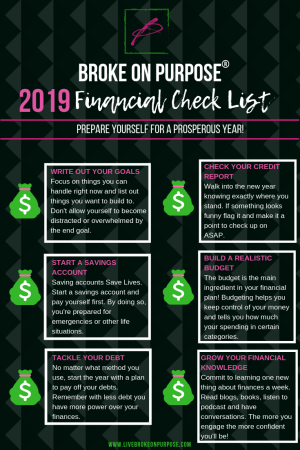

While there are many people to blame for the shutdown what we don’t need at this time, or for that matter ever, is people talking out the side of their necks blaming furloughed workers for not having savings or an emergency fund in place. Because let’s be honest, when you’ve missed two paychecks there is a high probability that the recommended $1000 emergency fund has been exhausted, and before we get on our ” you should have” soap boxes we also have to recognize that the ability to even save money is a privilege.

According to a 2017 report by CareerBuilder, 80% of Americans live paycheck to paycheck, many working multiple jobs just to make ends meet. So, even if one wanted to save money due to economic constraints and low wages, for many it’s not an option. To be honest even with a robust savings account, I still in some ways live paycheck to paycheck, because my life is based on receiving a check every two weeks to cover my expenses. Although, I’ve been privileged enough to be able to squirrel away money to tide us over until finding new employment nothing is guaranteed. For these reasons, I feel it is vital that those of us who have this ability/”privilege” to save money re-evaluate our responsibility to assist those who do not. Before you go all “that’s not my problem” on me, technically it is. When a large group of people suffers such as oh, say the 800,000 government workers who can’t pay their bills so does everyone else. It’s called the trickle down effect, and while you may not feel the brunt of the shutdown now, give it long enough, and you’ll find that it hits home in more ways than one. So, what can we do that will give others the opportunity to build a savings account? The answer is simple. We can do this by looking for ways in which we can help people create areas of excess/buffers in their budget so that they can save and prepare for that emergency or the next government shutdown (because we know it’s going to happen again, and very well may be worse)

So, what can we do that will give others the opportunity to build a savings account? The answer is simple. We can do this by looking for ways in which we can help people create areas of excess/buffers in their budget so that they can save and prepare for that emergency or the next government shutdown (because we know it’s going to happen again, and very well may be worse)

One way to help alleviate the financial stress of others is to create trends in your life that don’t require the financial obligation of others. Giving gifts during the holidays may be a tradition, but it’s not a requirement. Offer to forgo gifts and ask people to take the money they would’ve spent and put it away in a savings account. You could even start a savings account for them and gift it.

If you’re the type of person, who’s always been a giver and not a taker choose to give gifts that go the extra mile. Opt to pay a bill, a subscription/membership fee, babysit, or cook and bring meals during a busy week. This is the reason I always ask people what they NEED instead of what they want. These small gestures can alleviate a burden for many people and allow them to save the money

One thing I plan on exploring this year is to share the cost of food by buying groceries in bulk and splitting the items amongst family or friends. While we currently purchase our meat in bulk from BJ’s I would love to explore buying our monthly ration of meat in bulk from butchers and taking part in crop shares. For a small family, this may not be cost effective, but with multiple families combined you could save a lot of money. Group couponing can also be a great way to cut cost on essential items thus creating more room in the budget for saving money.

I’d be interested in hearing other ideas on how we can help people find or create buffers in their budget that allow them to save money. Please feel free to share them in the comments below so that others may incorporate these ideas into their own lives and communities.