*Update* Since this post, we’ve paid off the entire $13K in just Five Months and to date have paid off over $100,000 of our debt. Keep reading below to find out our process.

If your significant other, sibling, parents, or best friend told you that they had $13K in debt and that they were planning to pay it off in 4 months, would you believe that they could do it? Now, imagine this is you telling them the same thing, do you think that you can do it? It is easier to walk into debt than it is to walk out of it. You can blindly walk into a car payment without realizing the consequences to your financial house that your signature on that 5-year car loan will hold. You can easily talk yourself into needing that new computer so that your part-time business productivity will increase. You can justify those pillows, those sunglasses, and the randomness all by saying, “I’ll pay it off when the bill comes.”. The truth of the matter is you don’t. Instead of paying it off, you pay the minimum. Then, when you pay the balance down, you go out and buy more because the money is “available. Like TI says’s “It ain’t trickin’ if you got it,” but truth be told, you don’t have it. You never had it, and if you did, you wouldn’t be in this situation right — the case that is, unfortunately, normalcy in American households all over. You wouldn’t be in Debt.

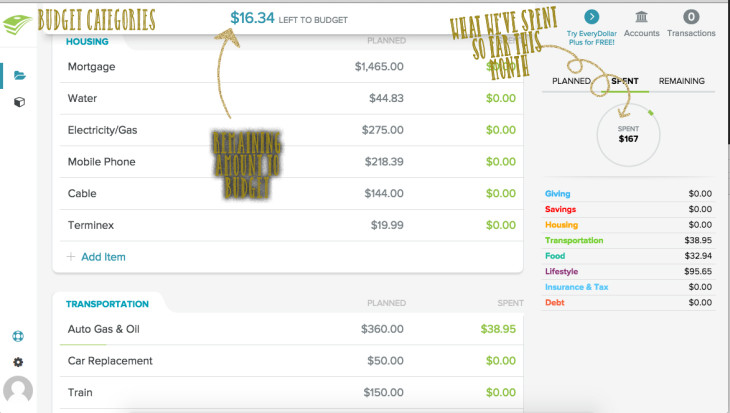

This past March, when I told my husband that I wanted to pay off over $30K in debt by January 2016, he laughed at me. He wanted me to “show him the receipts” as they like to say. I honestly didn’t have anything to show him, all I had was a burning desire to make it happen and to prove to myself that I could do it and that together we could change our financial situation. The first thing I did was to create a new budget. My favorite site to use and one that I recommend to absolutely everybody is Dave Ramsey’s EVERYDOLLAR.COM.

This website offers a FREE budgeting tool that makes sure you are giving every single dollar that comes into your life a home. There’s no more asking where my money went, or what did we spend that on because you already told the money where to go at the beginning of the month. Here’s what a sample of our Every dollar budget.

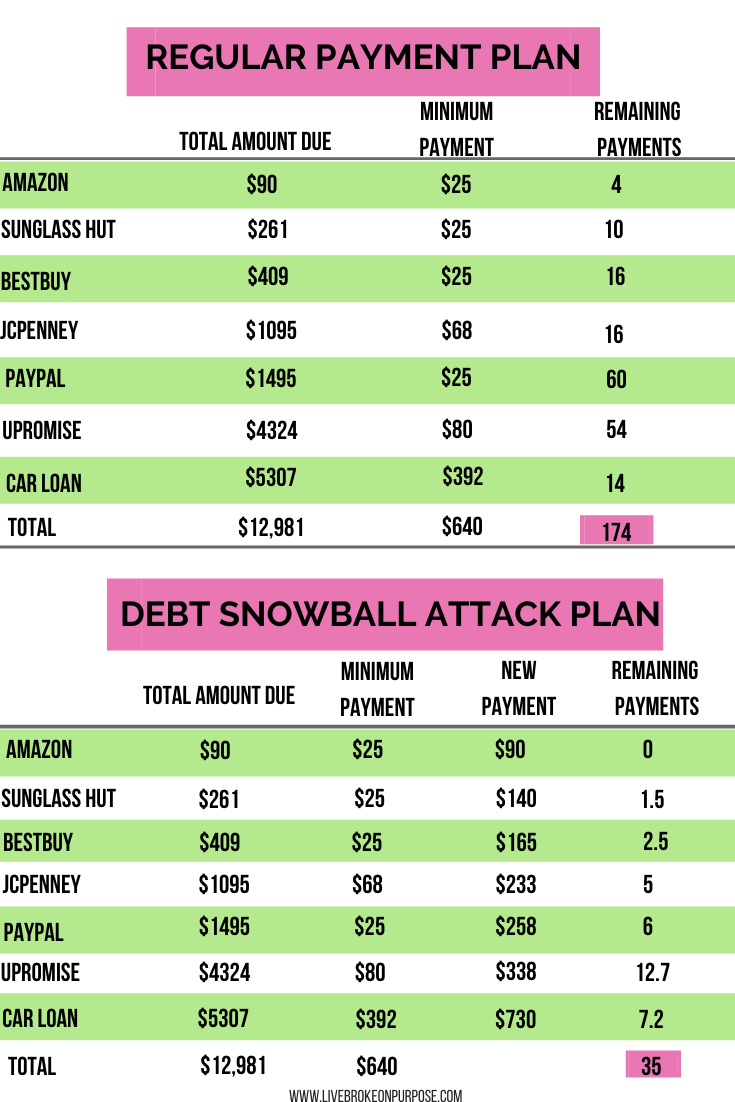

Secondly, I wrote out my Debt Snow Ball Attack Plan, which is a popular method used by Dave Ramsey in his Total Money Makeover Plan. Paying off debt via the Snowball method is a great way to accelerate your payments and get the debt paid off faster. For every debt you pay off, you roll the previous minimum balance into the next debt. I’ve shared with you the first part of our debt snowball plan below, as the second part contains our mountain of student loans.

I listed our debt from smallest to largest, disregarding the interest rates. If we were to work the debt snowball month to month, this is how it would work. Let’s say we’re starting in January. The smallest debt on the attack plan is Amazon, with a balance of $90. Instead of paying the minimum of $25 this month, we go ahead and pay the $90 in full, leaving us with “0” remaining payments. In February, we would now move on to the second debt on the list being Sunglass Hut. The minimum amount due is $25. With the debt snowball, we would roll the $90 freed up from paying off Amazon in January into the $25 minimum payment for Sunglass Hut. By doing this, we now are paying a minimum amount of $140 instead of $25, which means you will pay this bill off in 1.5 months. Now, let’s move on to the next bill, which will, in theory, start in April. The debt to focus on for April is Best Buy, and the minimum payment is $25. Instead of paying only $25, you will snowball the money freed up from paying the other bills into the $25 and now pay $165 that month as the minimum payment. Continue this each month until you’ve completed your Debt Snowball Attack Plan.

Now you may notice that in March, after paying off the Sunglass hut bill, you had extra money left over. Instead of spending that money or putting it into savings, you can immediately start on the next bill. For instance, in March, you would have had $19 leftover from paying off the Sunglass Hut Bill. Add that $19 in with the $25 minimum payment for Best Buy and start paying off the balance earlier than what your Debt Snowball Attack plan has designated. This is what we call working the “Accelerated Debt Snowball Attack Plan.” In the Accelerated Debt Snowball Attack Plan, you are throwing all the extra money you can earn at your debt. This is where you get mad at your debt and do whatever it takes to get rid of it as quickly as possible. Using the accelerated method, we went from a 35-month Debt Snowball Attack Plan to a 4 Month debt Snowball Attack Plan. In the first Broke on Purpose post, I did this by taking all the money I was earning part-time and throwing it at my debt. I even raided side savings account that I had and threw that money at the debt. My whole focus was to get rid of as much as possible.

The accelerated method is excellent for people who want to kick things into high gear and see movement on the debt snowball. Every little bit counts, it doesn’t matter if it’s $10, $20 or even $50. If you do the math, you’ll see how much momentum your debt snowball can quickly get. If the debt snowball isn’t your thing, you may be interested in the Debt Avalanche.

The order of your debt may also change. As I mentioned before, we always list our debt in order from smallest to largest and work the snowball method accordingly, in our Accelerated Debt Snowball Attack Plan, we paid off our Car Loan before we paid off our Upromise Credit Card. This happened is because the balance due on our car ended up being lower than what we owed on the Upromise Credit Card (we were paying $800 a month instead of the minimum of $329), and so it went first regardless of the interest rate.

Creating a Debt Snowball attack plan is the easy part. The hard part is not becoming overwhelmed by how many months it may take or the total amount of your debt. No one ever actually follows their original Debt Snowball Plan. Once you get started, you’ll begin on the accelerated plan almost immediately. Your payoff date may not be as early as others, and you may not be able to throw as much as you’d like to at your debt, but remember this is a marathon and not a race! You can do this!

Are you looking to create your debt snowball attack plan? Grab the Broke on Purpose Money Moves Worksheet Bundle here!