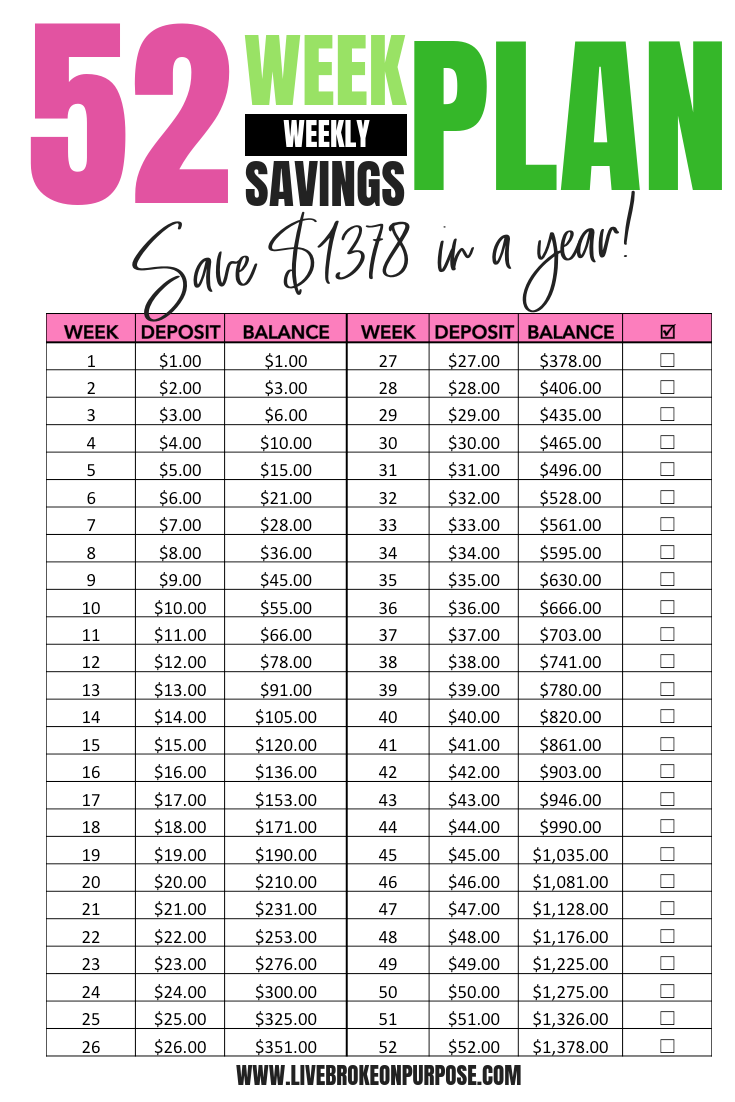

We all want to save more money or at least strive to build a positive habit of saving money. This reason is why the 52 Week Savings Challenge that typically pops up around this time of year is so enticing. It gives those who have never been consistent with their savings before a new and exciting way of going about it. By saving designated increments of money every week, you can save your way to over $1300 by the end of the year.

Of course, most things that sound too good to be true usually are, and the 52 Week Savings Challenge has its own set of pros and cons that one must take into consideration before jumping in and setting up your series of automatic transfers.

Read: Six Money Saving Challenges to Try This Year.

The Pros

The 52-Week Savings Challenge is a great way to build up your positive money-saving habit. If you were to follow the challenge as directed, you’d be putting money into your savings each week. Many may opt to set up automatic transfers. However, by choosing to transfer the funds from your checking into your savings manually account, you not only incorporate repetition, but you may find yourself looking forward to seeing your saving amount increase each time.

The next great thing about the 52-Week Saving Challenge is that because you’re saving upwards of $1300, you are going to be able to knock some stuff off your financial goals list by the end of the year. Not only that, if you don’t plan on spending the money on anything, you can set it aside as your emergency fund.

Though this challenge is supposed to be completed on a schedule, you don’t have to wait for the entire 52-Weeks to fund your account entirely. If you happen to get a bonus mid-year, you can use that money to cross some weeks off your calendar, allowing you to free up the money later on in the year to use towards other things. Many people like to work the challenge in reverse and use income tax returns, bonuses, or windfall money to complete the later months, where you’re saving upwards of $200 for the month.

Read: Three Ways to Handle Windfall Money

The Cons

Because so many people jump into this challenge sporadically, they don’t take into account how the weekly payments will affect their monthly budget or spending plan. By week 31, you’re saving $100 a month. If this has not been accounted for in your budget or spending plan, it can throw things off. Before you jump into the challenge, ask yourself if this is something you can realistically commit to doing for the entire year?

Another con to consider when it comes to this challenge is even though it’s supposed to be a fun way to save money, people typically drop off midway through because they haven’t established a solid reason for why they want to save. It’s almost like going to the gym. If you don’t have a reason for why you’re going, you’re never going, or know what you’re going to do when you get there; you won’t stick with it. To be successful with this challenge, make sure you know what you’re saving for so that you have a reason to keep going even when you don’t feel like making the transfer or putting the money in your savings.

As an alternative to the 52-Week Saving Challenge, write down a list of things you want to fund with savings. This list could include vacation, new tires, property taxes, or even yearly subscription renewals. Then come up with a date by which you want to have that money saved. To get the total amount you need to save each month, take the total cost of each item, and divide that by the number of months until your save by date. The total is the amount of money you need to put aside every single month to fund your goals. This method will give you a consistent amount to save each month.

As a financial counselor and educator, I am ALL about saving for the short- and long-term. However, like you, I have always had concerns about the 52-week savings challenges that seem to double the monthly savings or otherwise propose unrealistic amounts to deposit into savings accounts.

I enjoy spontaneity, but can’t it be planned spontaneity? Thank you for the needed common sense of recommending you consider the future impact of your savings plan.

I prefer a 52-week savings challenge that starts small and plateaus at around 10% after ten months. Even then, looking ahead to consider how you will need to change your lifestyle to accommodate 10% savings contributions is critical (getting rid of non-essential subscriptions, not buying a new car but looking for a nice used one, etc.).

And I completely agree with you on identifying a reason you are saving: vacation, vehicle, or something less exciting. Critical to success!