You know that old saying that goes “Don’t put all your eggs in one basket?” It’s probably one of the most real sayings of all times. If you want to get biblical about it, read Ecclesiastes 11:1-2 which says “Send your grain across the seas, and in time, profits will flow back to you. But divide your investments among many places, for you do not know what risks might lie ahead.” When it comes to saving money I am a follower of these principles and my motto is to always prepare for a famine while enjoying a feast. However, not everyone has discipline when it comes to savings. You may start off with good intentions by putting money in your savings account every month, but you’re easily tempted to spend it once you see you have a nice stockpile available. Or you have a tendency just to use it like it’s a backup for your checking account, whenever the balance is low you automatically move money over and presto chango problem solved, or so you thought.

One of the ways I changed the way I was handling my savings was by switching to an online savings account in addition to my regular savings. I’ve been using online saving accounts for years. Even when I was up to my eyeballs in debt I still made sure that I had at least a couple of savings accounts going, they may not have had much in them, but that’s not the point it was about the art of staying ready or our case trying to stay ready. By having all these savings accounts, I was practicing several important personal finance principles at the same time.

- I was making sure to pay myself.

- I was preparing for upcoming life events and emergencies.

- I was building positive financial habits.

During some of my Broke on Purpose® Consultations, people often tell me how they struggle with trying to keep their hands out of their own cookie jar, meaning their struggling with not dipping into their savings account. While we do discuss self-control, I also tell them that they should move the money somewhere where it’s not easily accessible. Think of it like when you have a young child that keeps touching and grabbing on things, what do you do? You move it out of reach, right? So why not use that same ideology with your money if you can’t keep your hands off of it?

Online saving accounts are a great way to do this. They function just like a regular bank except you can’t walk in there and take the money out whenever you want. In fact, to gain access to your money, you have to move it from the online savings and transfer it your checking which can take a minimum of three days before this transaction is complete. To me, this is awesome for people who dip into their savings accounts habitually. Due to the delay in being able to get your hands on your money you now have time to really think about if what you were planning on using that money for was worth it. Also, because access to that money isn’t instantaneous, you’re more likely to leave it alone. Think of these online savings account as a virtual money envelope. Instead of having an envelope that you stash in your home you can have your money in a secure place. You also can fund these accounts easily through automatic transfers and manually scheduling deposits from your linked checking account or by setting up deposits via payroll so that every time you get paid money is automatically added.

My favorite online bank is Capital One. I love the site because it’s so simple and easy to use, plus their phone app is very user-friendly. Can I age myself real quick? I’ve had these savings account before they became Capital One Saving Accounts. Anyone remember ING Direct? They were originally who I opened my accounts with before Capital One took over. Some of my online savings accounts are 12 years old! What I love most about having Capital One Online Saving accounts is that while they’re FDIC insured and function as a normal bank there are NO FEES AND NO MINIMUMS. I’ve had accounts sit with a $0 balance for months and, I’ve never been charged a fee. No direct deposit? No worries, you still won’t get charged a fee.

Want to know something else pretty darn exciting about Capital One online Saving Accounts? You can make money by saving money. Capital One savings account start at a 1.00% APY. Compare this to your regular bank which probably has .001% interest.

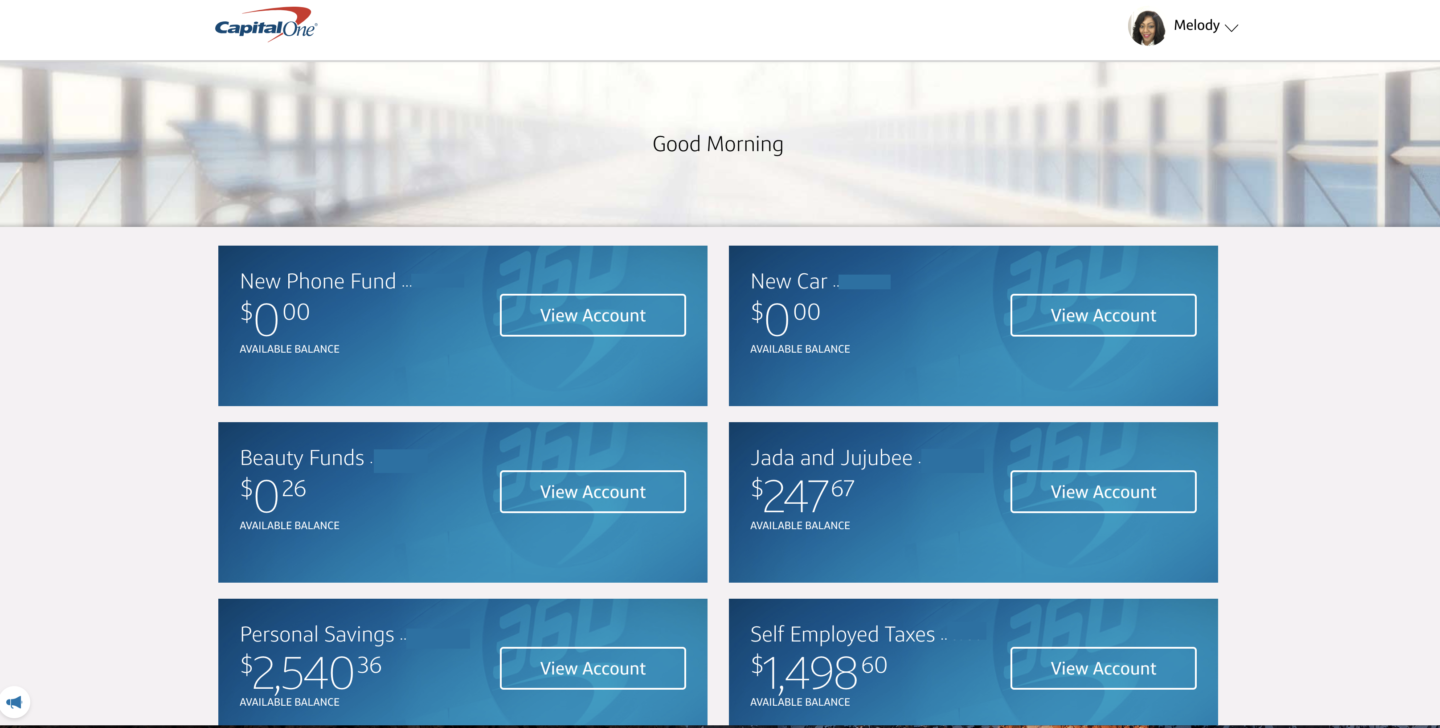

Here’s a sneak peek at what our Capital One 360 Accounts looks like via their homepage. Everytime you open a new account, which only takes a second, you can rename it to reflect your savings goal as you can see in the picture below. Right on the front page, I’m able to see my accounts laid out in block style and how much is in each of them. Notice we have a few accounts with nothing in them. Marcus and I just recently opened these accounts to start saving up for a new car purchase that’s a few years down the line and to save up to buy new cell phones since ours are almost three years old and we don’t like to do payment plans.

We do not have our Emergency Fund in a Capital One Savings Account. Remember when I mentioned that there is a slight delay with the transfer of money? Because of this, we choose to keep our emergency fund with our regular bank for easy access.

If you’re ready to rethink where you save your money you might want to consider a Capital One Online Savings Account. It’s free to open one and like I said there are no fees! Right now when you open a new account, you can get a $25 bonus.