Money Challenges are a great way to motivate yourself to save money and get out of debt throughout the whole year. They range from the simple task of putting extra change a designated savings jar or to saving up $5000 towards a down payment on a house. The type of money challenge you choose is going to be largely based on your goals and financial ability, but if you stick with it the entire year, you will see amazing benefits and hopefully learn healthy money habits. Below are the six money challenges you can try out this year.

The 52 Week Money Challenge

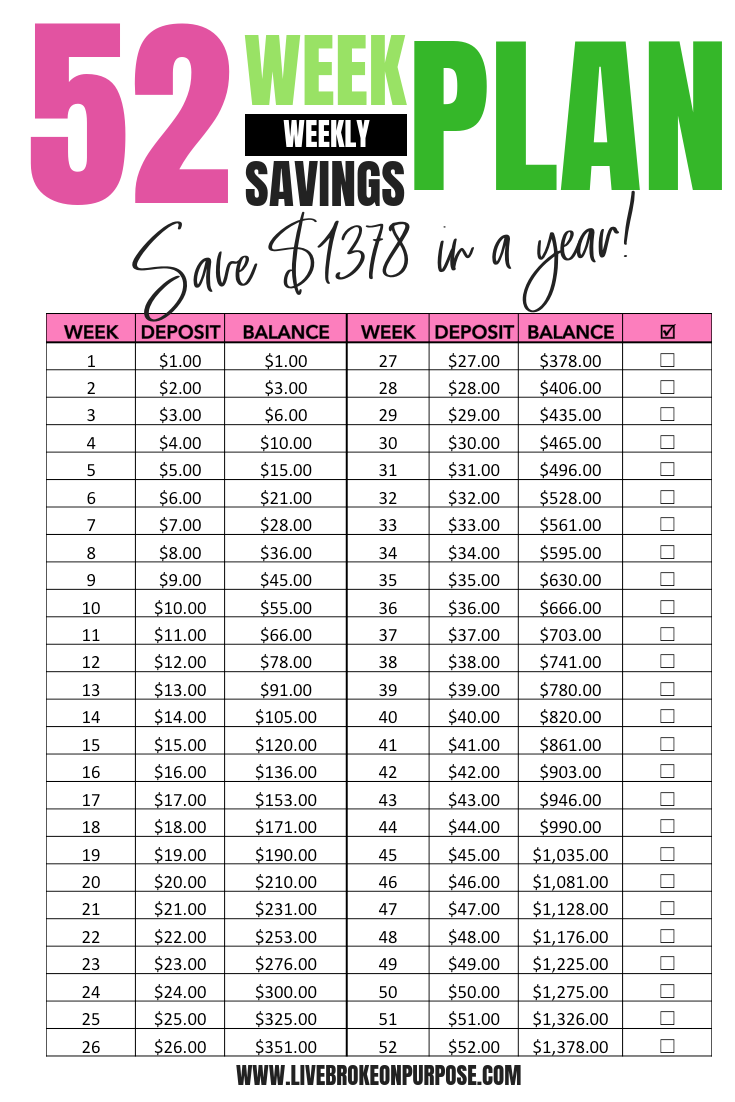

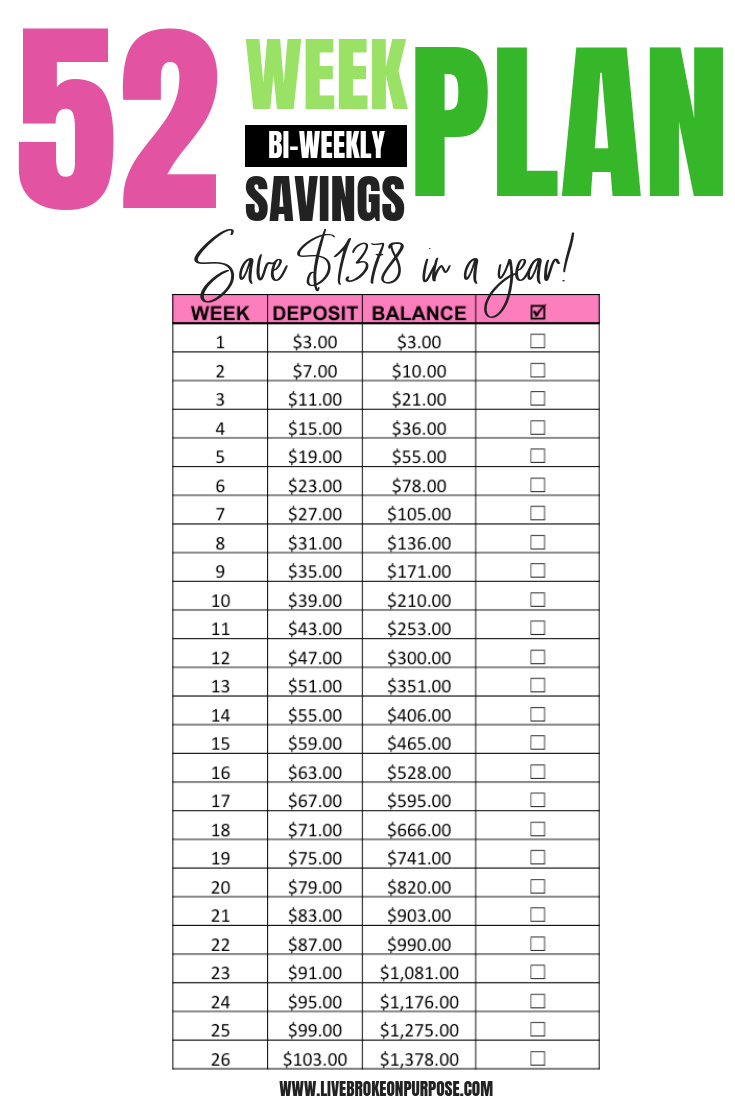

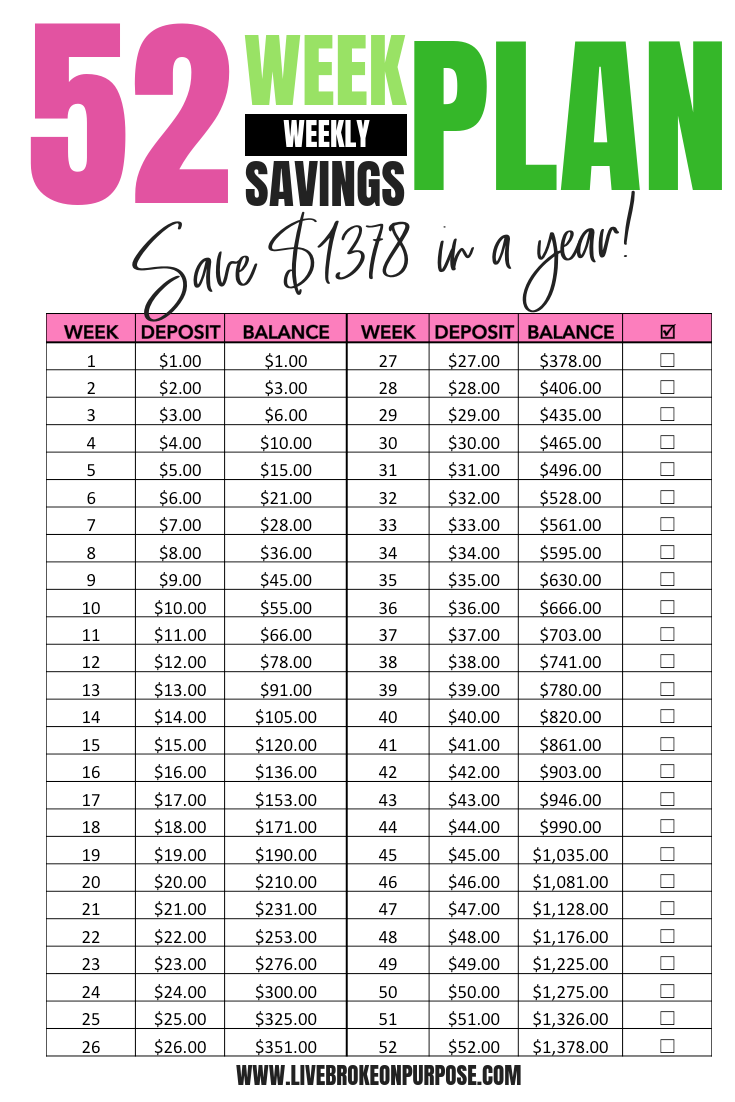

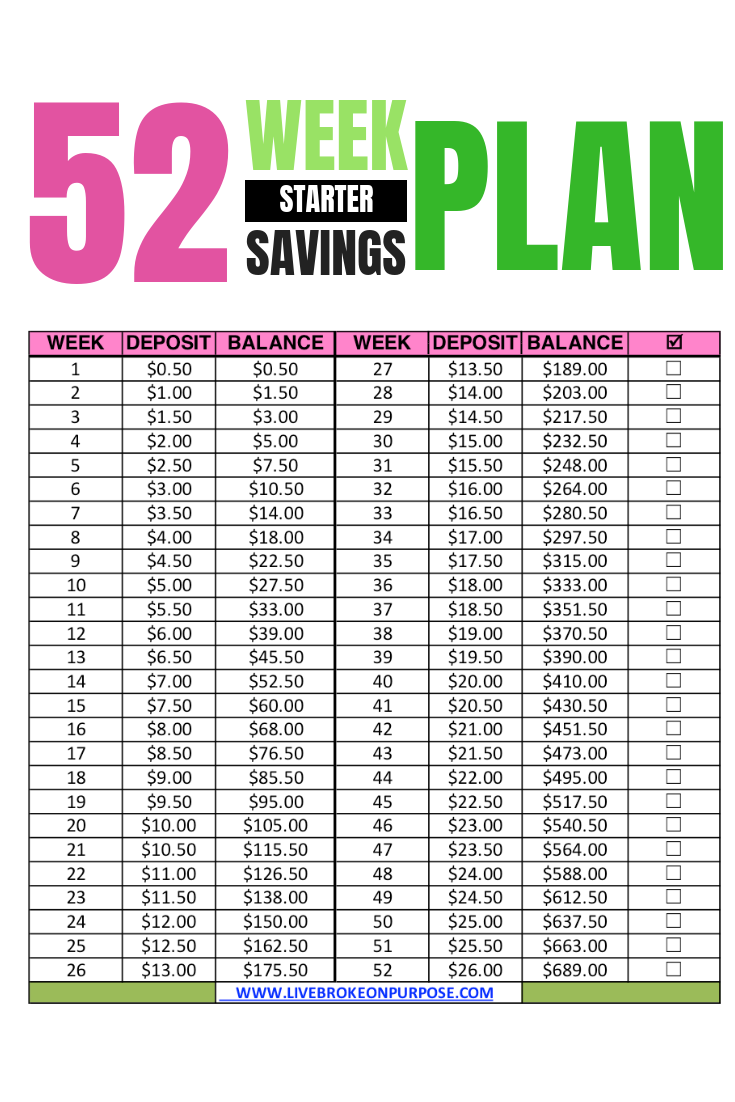

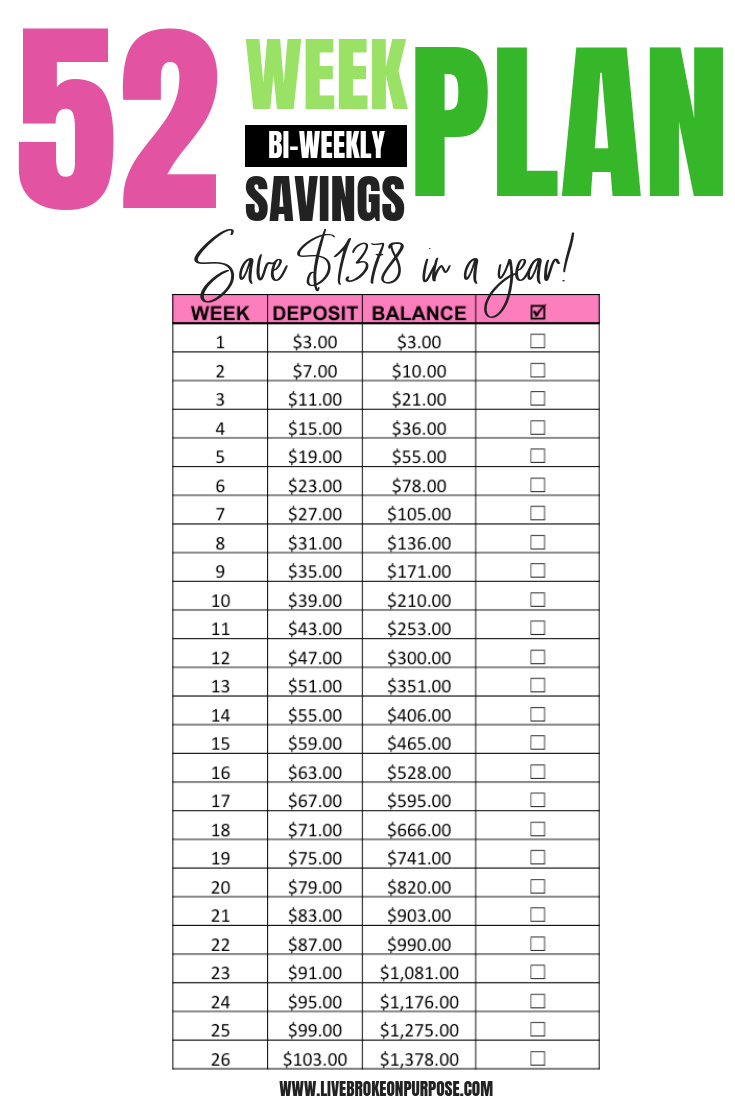

The 52 Week Money Challenge challenges you to put a certain amount of money into savings every single week. You start by saving a $1.00 the first week and then double the amount to $2.00 the second week. You continue increasing the amount every week until at the end you’ve saved over $1300! The plan is going to be different based on your pay schedule. Below I’ve included a free download based on a Weekly and Bi-Weekly Pay Schedule. Here are some important things to keep in mind about the 52 Week Challenge. As the weeks go by the amount you’re supposed to save will become significantly higher. In the later weeks, you may be required to save more than your budget will allow. Alter the schedule to work better for you, save more at the beginning and cross off several weeks at a time by using your income tax refund including money you get from windfalls.

Weekly Schedule Bi-Weekly Schedule

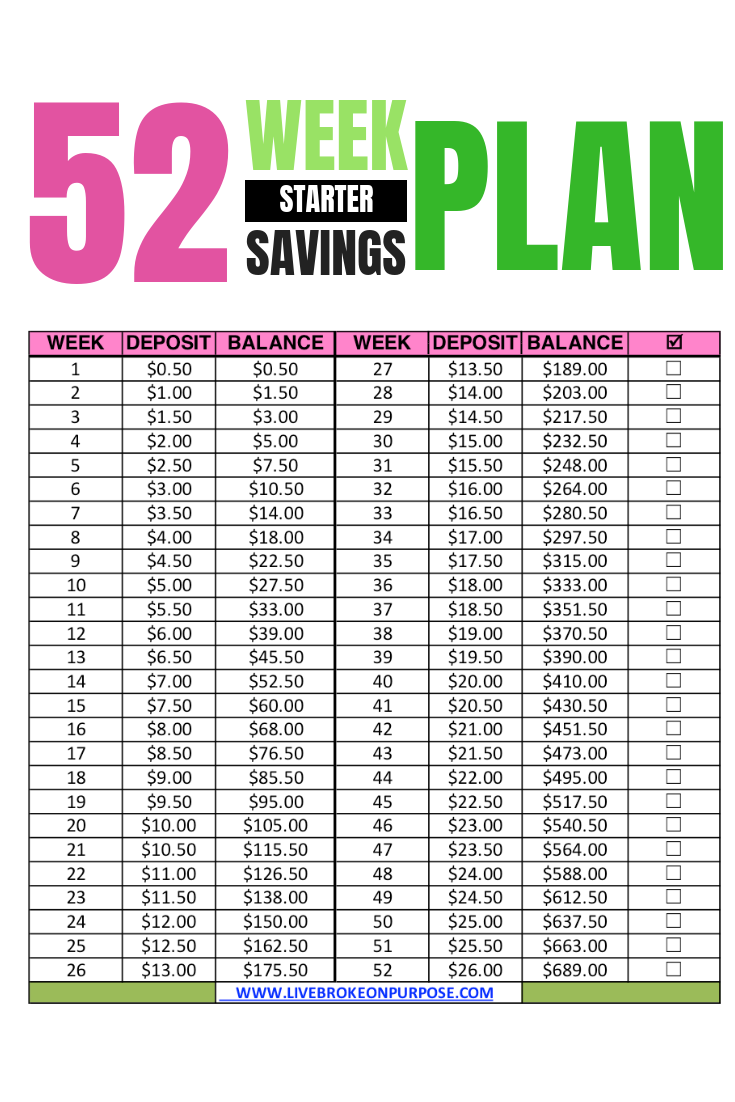

The Starter Savings Challenge

The Starter Savings Challenge is an excellent challenge for those just starting. It’s especially great for those who can’t afford to pay the large amounts required towards the end of the year in the 52 Week Challenge. In the end, you will have saved a significant amount of money. I recommend this challenge for those wanting to save for Christmas or those looking for a way to put away money without thinking about it.

The Save $5000 for a Down Payment Challenge

I recently stumbled upon this challenge on the Facebook Page of Denise Hadnott. I’ve not quite figured out the breakdown of the payments each week, however, at the end of the year, you will have saved $5000. There are a few weeks that require you to save $200, again for many this may not work with your budget. However, this challenge is great if you’re working towards saving up for a downpayment on a house but keep in mind to avoid PMI (Private Mortage Insurance) one needs at least 20% down. This method is also a great way to save up for a car or any other big-ticket item.

The Credit Card Pay Down Challenge

This challenge can save you big bucks in the long run. In January, you call up all your credit card companies and see if you can negotiate a lower interest rate. You then list your balances from smallest to largest. Does this sound familiar? Yep, it’s the Debt Snowball. You start off by paying as much as you can on the smallest balance while only paying the minimum on the other cards. Once you’ve paid off that first card, you roll the amount you were paying into the next card ( this is where the snowball action takes place.) Continue until you’ve paid off all your cards! Using the debt snowball method we were able to pay off all of our credit cards in as little as 5 months! To learn how to set up your own Debt Snowball check out this post here.

Save Those Fives’ Challenge

The Save Those Fives’ challenge is perfect for those who use the Money Envelope method of budgeting. With this challenge, you save all the five dollar bills you get. In theory, it seems simple, but in reality, it can be a bit tough. One reason why is that it will throw off how much you have in your envelope so you’ll really have to stay on top of your budget.

The Cash Envelope Challenge

I get excited every time I see someone pull out their money envelopes to pay for something in a store. This is the ultimate challenge. It’s the challenge on top of a challenge because you’re forcing yourself to put down the debit and credit cards and only use cash. It’s honestly my favorite way to budget, which is why I came up with the Broke on Purpose® Money Envelopes. I wanted a fun way to budget my money and to give me the motivation to keep going. With the Cash Envelope challenge, you’re budgeting a monthly amount into your envelope but you’re challenging yourself to find ways to spend less so that at the end of the month you end up with money left over. With this leftover money, you can add it to your savings, use it to pad your envelope next month, or even treat yourself to something fun.

If you don’t want to do money challenges, it’s super easy to set up automatic transfers into sinking funds that will take money from your bank account and place it in a savings account. This is great set it and forget it way to save money.

PIN TO PINTEREST!

Great ideas! I have accepted the 52. Week challenge in reverse order…

I just finished the 52-week challenge this year and I’m ready to start over again! For 2017, I think I’m going to double each week’s savings amount so I end up with twice as much at the end of this upcoming year.

And if you were having trouble staying motivated throughout the year like I was, I found this website where you can take the 52-week challenge with other challengers, so everyone can keep each other motivated. I’ll post it here in case anyone else might find it useful: https://www.money-challenge.com

Good luck in 2017 everyone!

I need 26 week–biweekky savings challenge

I asked the same question on IG and I still don’t see one here for 26 weeks

Hi Lisa, The BI-WEEKLY PLAN is 26 weeks and is posted twice on this page.