This is our 2018 Financial Roundup and personally, 2018 is a year where I want to say Thank you, but Next! This year indeed showed me what I was made of. As I reflect on how I was feeling this same time last year I can’t help but be in awe of the beauty of time, and how each day gives you a chance to learn new lessons, refind yourself, and come back stronger than ever. For those just popping in let me share some cliff notes. This time last year I walked away from a very healthy salary due to my mental and emotional health. That decision took its toll on me, and for the first half of 2018, I was fighting to keep my head above water.

I was fighting to appear normal to family, to friends, sadly to even strangers who didn’t know me.

I was gracefully broken.

The hardest part about walking away from my job was trying to figure out how we were still going to achieve our big outrageous financial goals. We’d made plans around that salary (can we say mistake?). Pulling back was hard for me. Setting financial goals was a huge part of who I was. I’m a goal oriented person. I say I’m going to do something and I do it. I wanted to set goals and then crush them to smithereens. I wanted to laugh in the face of my debtors as I denied them all the interest they thought would accrue, I wanted to be the hero, but how can you be a hero when you’re financial word has just been turned upside down?

Lucky for us, because we took the initiative in 2015 and started wiping out our debt we were able to live comfortably just on Mr. Broke on Purpose’s salary. This is a blessing for which I can never stop saying thank you.

We had to do a Financial Pivot and Switch.

I had to set new challenges for myself like learning how to coupon and looking for ways to reduce areas in our budget.

This year forced me to step outside my comfort zone and After reading Jen Scinero’s book “You Are A Badass.” I knew that if I wanted things to happen, I had to force my hand. I had to give myself a reason to bounce back.

I started by applying to go on retreat and telling myself I wouldn’t worry about financing until I knew if I was accepted.

I was accepted. So, I got a part-time job working at Home Depot to cover the cost and cash flow the trip. You never know what you will do until you have to do it. For me, a part-time job wasn’t a step back; it was a step forward to going after what I wanted.

“When you up-level your idea of what’s possible and decide to really go for it, you open yourself up to the means to accomplish it as well.”

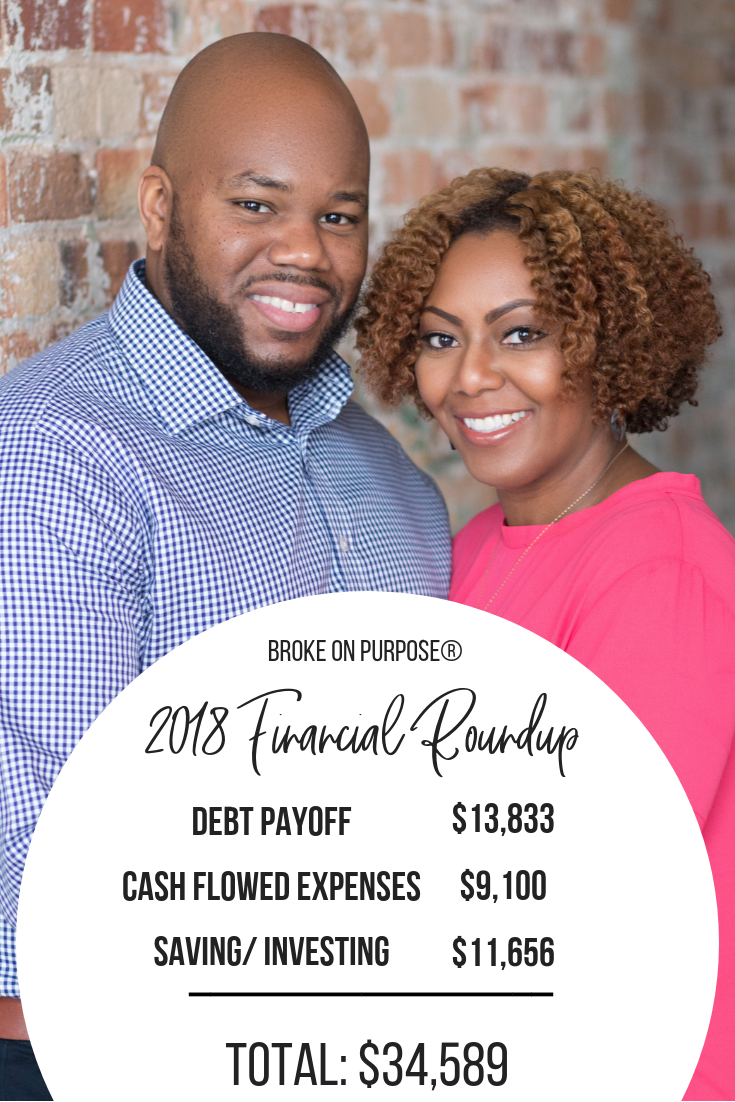

2018 Financial Roundup

Since then, I’ve been continually pushing myself out of my comfort zone and forcing myself to step up to the plate. In May, I started a full-time job and instead of going immediately back to paying off our debt with the extra money we reassessed our lives and asked ourselves what else we wanted to do while working towards being debt free.

We decided we wanted to live and so we gave ourselves permission to experience life while restructuring our financial goals (the financial pivot and switch). Paying off debt, and becoming debt free will always be important to us, however, I no longer feel my world will end if we don’t achieve it by a specific date.

This year we made significantly less money and lived on one income for five months, however when we tally up everything we were able to do regarding savings, paying down debt and financing other expense it doesn’t even feel like we missed a beat. While this amount could have totally wiped out one of our Student loans, I’m okay going in 2019 knowing that our saving accounts look sexy, our sinking funds are set up and ready to be filled, and our debt no longer defines us. We cashed flowed the purchase of a new mattress, new Mac Book Pro (I spilled ranch dressing on my old one), and an upcoming trip in May. We’ve beefed up our emergency fund over $10,000 and contributed to our ROTH IRA’s every month.

These are things we wouldn’t have done if life didn’t come and pull the rug from under me.

In 2019, we’re setting S.M.A.R.T goals for our finances. No more just how much can we pay off, but we’re asking ourselves what can do we do to make our money grow. We’re even thinking of adopting some traits of FI/RE. All in all, this is the beauty of personal finance. The goals you set, the things you accomplish and what you learn along the way all are all specific to you. You have the power to write the ending to your own story.

Thanks for sharing. So happy for you

I can relate to so much of this. Thank you for sharing!